Around the world, across different markets, investors have reacted in great anxiety anxiety especially to the ongoing gridlock between the White House and Republican lawmakers over a path toward raising the government’s debt limit and avoiding a potential default.

A deal on the debt limit is needed for the government to avoid running out of funds to pay its bills and other obligations after 2nd Aug 2011. The IMF delivered its warning as the White House and Congress struggled to reach a deal to increase the federal government’s borrowing limit before the 2nd Aug 2011 deadline.

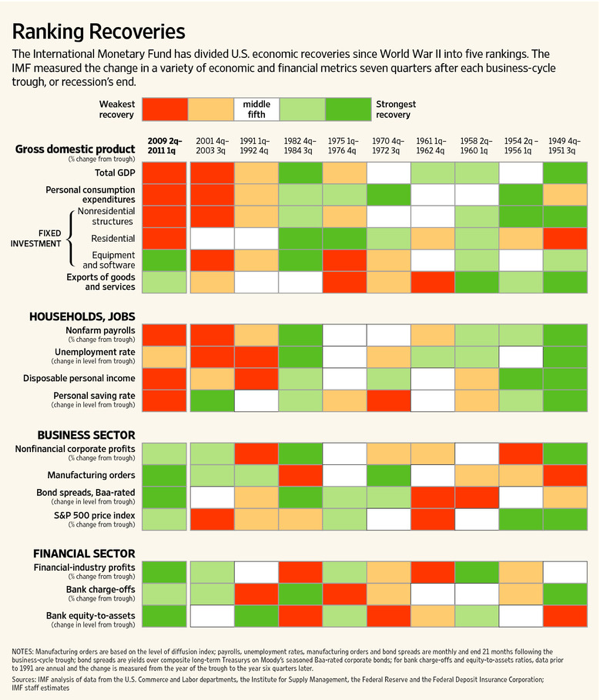

On the US economic front, the IMF said it expected the U.S. economy to expand at a modest pace, with inflation-adjusted growth of 2.5% this year and 2.7% next year. The IMF report also highlighted the uneven nature of the U.S. recovery. The financial industry and businesses (particularly large companies ) have improved, while housing and labor markets remain weak:

Here are some scenarios for raising the debt limit by the early August deadline to avoid a potentially crippling government default:

1) All spending cuts

2) Short Term debt limit increase

3) Obama invokes the constitution (The fourth section of the 14th Amendment states that the United States’ public debt “shall not be questioned”)

Obama has also warned of economic “Armageddon” if the United States defaults on its debt and has urged Democrats and Republicans to work together to forge a deal on raising the government’s $14.29 trillion debt ceiling.

A U.S. debt default would ramp up the cost of U.S. government borrowing and could lead to a loss of faith in liquid U.S. assets as one of the safest destinations for investors, which would trigger more selling in the dollar.

Dollar would remain at the mercy of U.S. policymaker comments in the next week, and that any suggestion of a continuing deadlock would slap the currency lower. Gold futures are up close to 10% since the beginning of the month, thanks to a streak that saw records broken during four consecutive sessions. Physically backed gold exchange-traded funds have reported record inflows. In Asia, where investors participate in the gold market through purchases of high-carat jewelry, dealers have also been reporting strong sales. The classic safe haven, gold, is now reaping the benefit of the mounting aversion to risk.

Technical Analysis – Spot Gold

With rising risk aversion and weakening USD, there is no surprise for Gold as a safe haven investment vehicle to breech upper band at $1560 during mid July to test the target of $1640. Near term support will be at $1600. However, the current bull steam could be dampened with weakening STO and MACD. RSI is also flattening out. Prices should consolidate for the time being and position stop loss below $1600.

Technical Analysis – Spot USD Index

USD has breeched lower band at 74.5 but it has not tested the recent low of 72.5. Chance of retesting that level depends on a convincing clear of the most recent lows past 74. Stop loss should be positioned above 74.8. Risk aversion should propel certain currency pairs such as USD-SwissFranc and USD-Euro.

Read other related posts:

Follow us on:

Share this article on: