On 22nd July 2014, Apple (AAPL) announced their latest Q3 2014 results. Comparatively, the results are impressive considering the margins are largely maintained yet on a growing quarterly revenue Y-on-Y. Undeniably, iPhone is still the main revenue generator for Apple (AAPL) followed by iPad. Though for the sales volume for iPad has dipped Y-on-Y. With the upcoming refresh for iPhone…

Tag: US Stock Market

Apple stocks plunged 9% after announcing their Q1 2013 results – a bargain buy? | Fundamental Analysis | US Stocks

Apple (AAPL) just announced their fiscal 2013 Q1 results which came in ‘unspectacular’ against what traders were anticipating. Nevertheless, it is still a very decent report card if we do look into the details. Key performance summary: Revenue: $54.5 billion versus $54.58 billion expected EPS: $13.81 versus $13.34 expected Gross Margin: 38.6% versus 39.5% expected iPhone: 47.8 million versus 50…

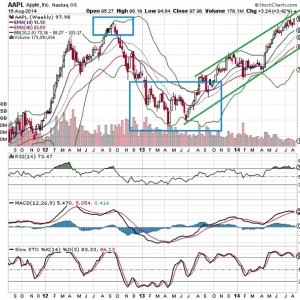

Apple missed the financial forecasts again – how’s the market responding? | Technical Analysis | US Stock Market

Last Thurs (25th Nov), Apple (AAPL) announced its earnings for its fourth fiscal quarter of 2012. Apple’s revenue amounted to $36 billion in Q4. With earnings of $8.67 per share. Apple posted $8.2 billion in profit. The revenue numbers beat industry estimates, but profit did not. The company is still making boatloads of cash and its revenues were higher than…

SoftBank makes aggressive investment in Sprint – short term dilution but long term strategic move | M&A | Stock Market

One of Japan’s largest wireless carriers, SoftBank Corp is spending $20.1 billion to gain a foothold in one of the world’s biggest and most lucrative mobile markets. SoftBank Corp., Japan’s third-largest carrier, is taking a 70% stake in struggling U.S. carrier Sprint Nextel Corp. It would mark the largest-ever overseas acquisition by a Japanese company. Softbank Corp.’s $20 billion takeover…

US stock markets have run ahead of reality? | Fundamental Analysis | US Stock Market

All eyes are on Fed’s next move and whether there is further QE3. Already as it stands, the interest rates are low till 2013 and reported profits for most listed companies are racking in above and inline with analysts’ estimates. Looking closer into the macroeconomics trends (depicted below), the slowdown is still persistent but personally it does not truly warrant…

Financial sector a big laggard or a sign of bigger storm ahead? | Technical Analysis | US Stock Market

For the past quarter in 2012, Dow Jones Industrial has seen a steady upward price momentum with key indicators also ticking up. Nevertheless, the volume has not been too comforting, coupled with much in-decisiveness depicted in wide weekly range swings and doji formations. Interestingly, the DJ Financial Index has been a big laggard against the general DJI components. It is…

Apple Q3 2012 earnings as a catalyst to new highs for AAPL stock price? | Technical Analysis | US Stock Market

Apple is set to announce her Q3 2012 earnings July 24 at 5 p.m. ET. It is largely expected that iPad sales to easily beat last quarter’s, and iPhone unit sales to slow down. Apple is widely expected to introduce a new iPhone in Oct 2012, some would-be customers will be holding out for the new model. In Q2 2012,…

US Bank stocks badly sold off with increased market uncertainty | Citigroup, BAC | US Stocks

Across the globe, U.S. economic data released in the past week were mostly upbeat – increases in sales of new and existing homes, an unexpected rise in durable-goods orders and a climb in the consumer sentiment index to its highest level since October 2007. Now the focus of weary eyes are on these key macroeconomics developments: a) The risk of…

McDonald’s (MCD) has a change in top management – business profitability should be intact | Accumulation on weakness | US Stock Market

On 23rd March 2012, Jim Skinner was set to retire from McDonald’s (MCD) after 41 years with the fast food giant, the last seven and a half as CEO. Skinner will be handing off to Don Thompson, the chief operating officer and former head of McDonald’s USA, on June 30. Thompson moved from engineering to operations after just a few years at…

Better than expected US economic data has restored some confidence in sidelined traders | Fundamental Analysis | US Stock Market

US economy has finally shown hope of a recovery, if not definitely signs of bottoming. On Friday, US Stocks took off after the Labor Department reported the addition of 243,000 jobs in January, the largest jump in nine months. The unemployment rate fell to 8.3%, the lowest since February 2009. a) Manufacturing Jobs – Largest growth since Jan 2010. b) Service…