China MinZhong (K2N.SI) is one China based company listed in SGX which underwent such tremendous change of events in just one week. It all started on 26th Aug 2013 when Glaucus issued a report on suspicious operations within the company. It is also noticeable that the coverage by analyst steadily declined over the years even though the reported revenue is…

Tag: singapore stock market

Part 1 : Cyclical sectors as focus during market bottoming – Bank stocks | Fundamental Analysis

Ever since Dec 2011, Singapore Straits Times Index (STI) has managed to U-turn from the lows of 2600 to the current consolidation at 2900-3000. Cyclical sectors are typically the first ti be deeply corrected but also the few which will rally once the market has consolidated our of its bottom. In the 3 part series, lets take a quick overview…

Straits Times Index surges as sentiments improves | Take Profits or Buy into Strength? | Singapore Stock Market

Singapore stock market was once again sizzling after a Hari Raya holiday break. On the last day of the month, the benchmark Straits Times Index was up 93.37 points to close at 2,885.26. Gainers outnumbered losers 513 to 89. A total of 2.28 billion shares, valued at $2.44 billion, changed hands. The strength in the day volume signify the return of…

Keppel Corp (KepCorp) – Stock with good valuation amidst weak market sentiments | Accumulate on price weaknesses | Singapore Stocks Review

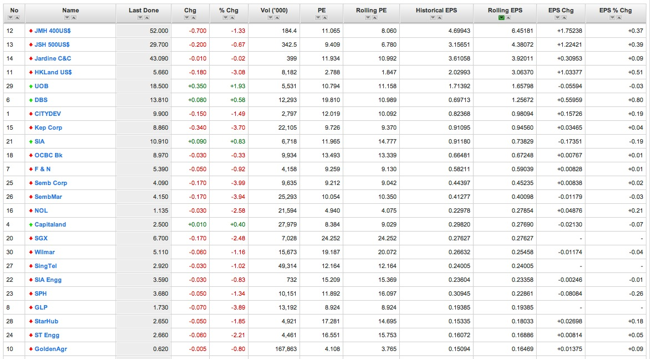

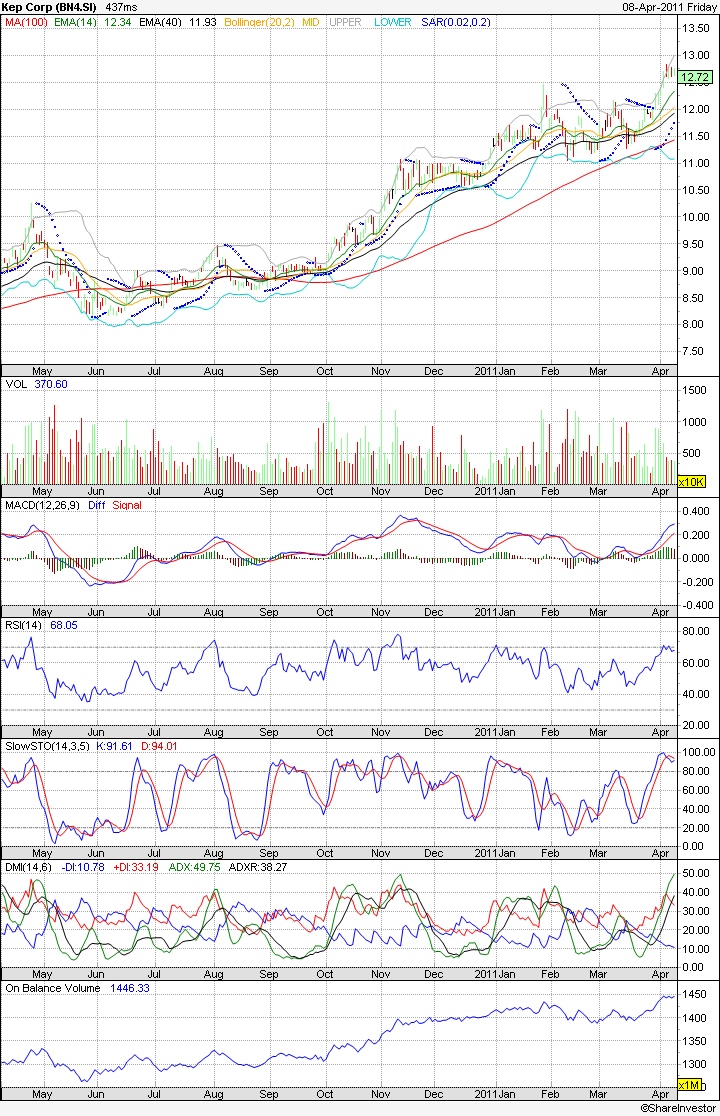

Keppel Corp (KepCorp) is among the Singapore Blue Chips which was highlighted in my previous post on good valued stocks to keep a watch out during this financial volatility. Keppel Corp is a Singapore-based conglomerate with businesses engaged in rig-building, utility operation, and property development/investment. The company is one of the world’s largest rig-builders in terms of global market share.…

Stock Picks – Good bargain Singapore Stocks for buying and slow accumulation on price weaknesses | Fundamental Analysis | Singapore Stock Market

Stock market crashed multiple times in entire history and being humans we are always affected by fear & anxiety. We will ask the same question whenever it happens – “Will it go lower?”, “It is only the start…?”, “What’s wring with everyone?”, “When can we enter?” … Like any other technical and fundamental (2in1) analyst, we have the advantage to…

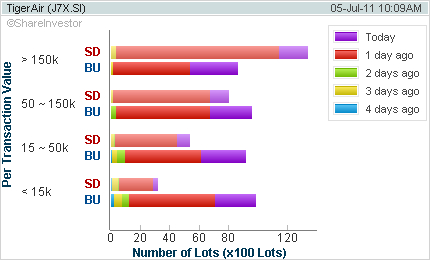

Tiger Airways – Near term impact and stock price weakness as opportunity? | Fundamental Analysis | Singapore Stock Market

On Fri 1st July 2011, the air safety watchdog Civil Aviation Safety Authority grounded all Australian domestic flights of a Tiger Airways subsidiary for the next week, saying the budget airline twice flew under the minimum allowed altitude. Tiger Airways, the fourth-largest domestic airline in Australia, operated between all state capitals and several regional cities. Tiger is 49 percent owned…

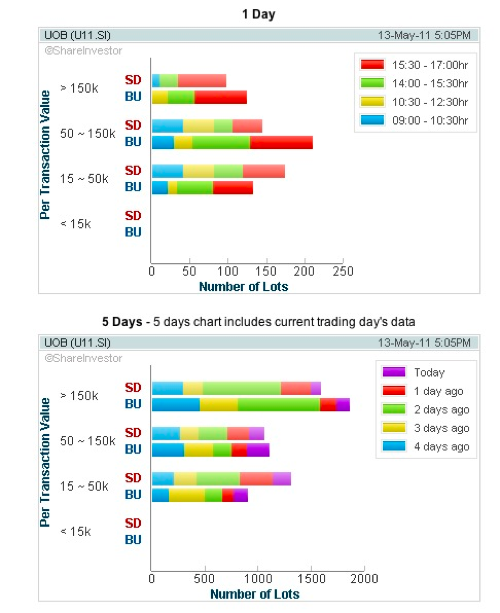

Singapore Banks – DBS (D05.SI), OCBC (O39.SI), UOB (U11.SI) – Accumulate on further stock price dips | Technical Analysis | Singapore Stock Market

After the Singapore Elections 2011, now it is the time to re-focus on the growth potential of Singapore Economy. As domestic activities increase, banks will be the key group of stocks to benefit, DBS has the greatest PE of 20 while UOB has the lowest PE of 11.4.Net earning growth % is the strongest in UOB. Based on the fundamentals…

Cosco – short term economic threats should not jeopardise long term recovery | Technical Analysis | Singapore Stocks

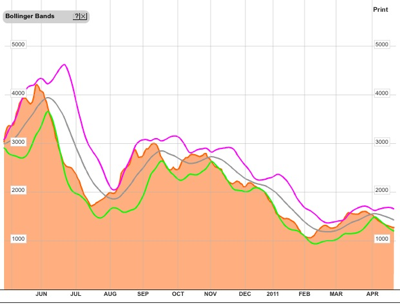

It has been awhile since I last touched on Cosco. During Feb 2011 when I last issued a sell call on technical weaknesses, the stock has tested a significant low of $1.80. That was worsened by the Japan Earthquake which causes much anxiety on a standstill or worsening of the world global recovery. Near term basis, shipbuilding activity and traffic…

Genting.SP has more price consolidations ahead | Stocks Review | Singapore Stocks Market

Ever since the Genting stock price touched its historical high of S$2.34, it has then undergone a series of downward consolidation within $0.200 price channel. The recovery from the 3 months low from S$1.85 provided some hope to breakout of the consolidation channel but the divergences in both its daily volume and MACD were signs of disappointment. Watch out if…

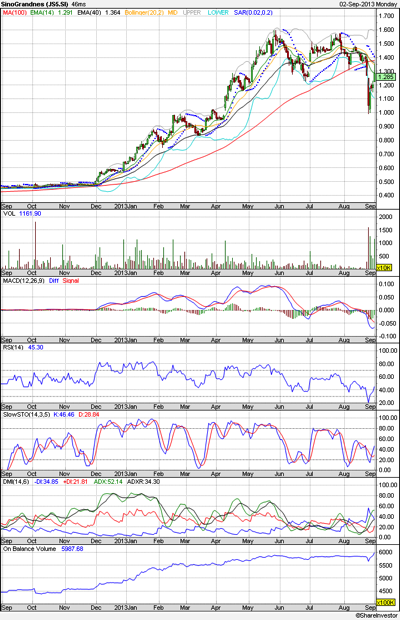

KepCorp – decent rise but underperform STI | Stock Prices | Singapore Stock Market

Singapore stocks have a good run up from last month lows. STI recovered a good 11% but KepCorp had only a mere 8%. It’s among the laggards as it’s stock price has breached resistance at $12 to attain 3 years high. Volume has not picked up to my expectations and both RSI, ADX are showing signs of weakening, though OBV…