STI has been consolidating since Aug 2013 within a tight band. Current support is at 3080 & its resistance at 3180. Momentum is also slowing with bearish divergence forming at both volume & MACD indicators. More convincing breakout should happen beyond 3200. Quick look at some key FTSE ST Indices: A) FTSE ST Financials Index (FSTAS8000.SI)– Short term movement :…

Tag: Singapore Stocks

China MinZhong – From a short target to a takeover target, all in a week span | Fundamental Analysis | Singapore Stock Market

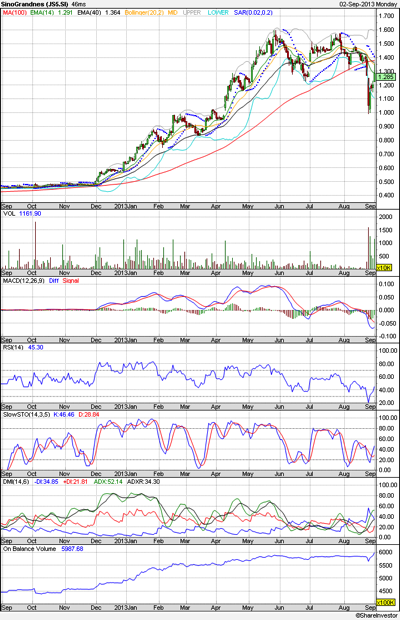

China MinZhong (K2N.SI) is one China based company listed in SGX which underwent such tremendous change of events in just one week. It all started on 26th Aug 2013 when Glaucus issued a report on suspicious operations within the company. It is also noticeable that the coverage by analyst steadily declined over the years even though the reported revenue is…

Retracement for Singapore Stocks – Time to value pick SG Financial Stocks? | DBS, UOB, OCBC Banks | Singapore Stocks Market

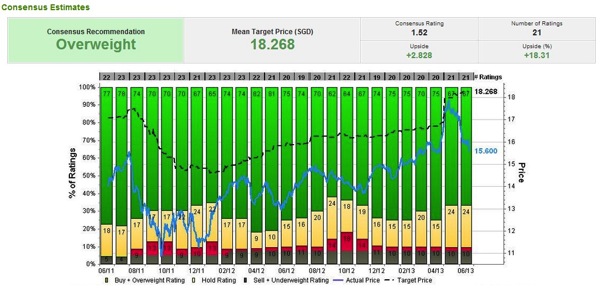

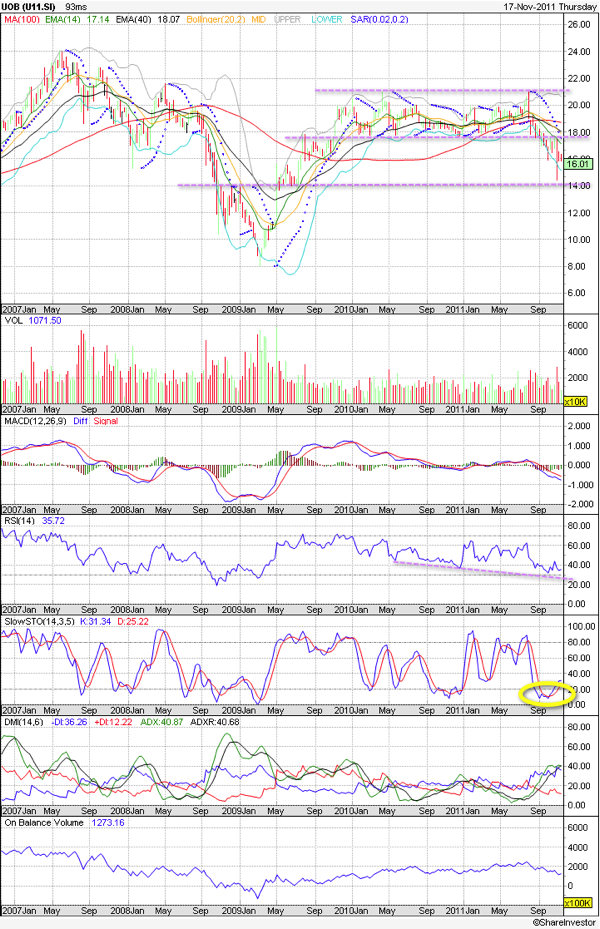

For the past week, global markets including Singapore have suffered continued weakness arising from general expectations for Fed to reduce QE and a stronger Yen. These triggered investors to unwind their positions in equities and even the commodities market was not spared. That said, it does present a good opportunity to consider value entry. Particularly, the ST Financial Index has…

Straits Times Index hitting key resistance – Take profits on further strength | Technical Analysis | Singapore Stock Market Review

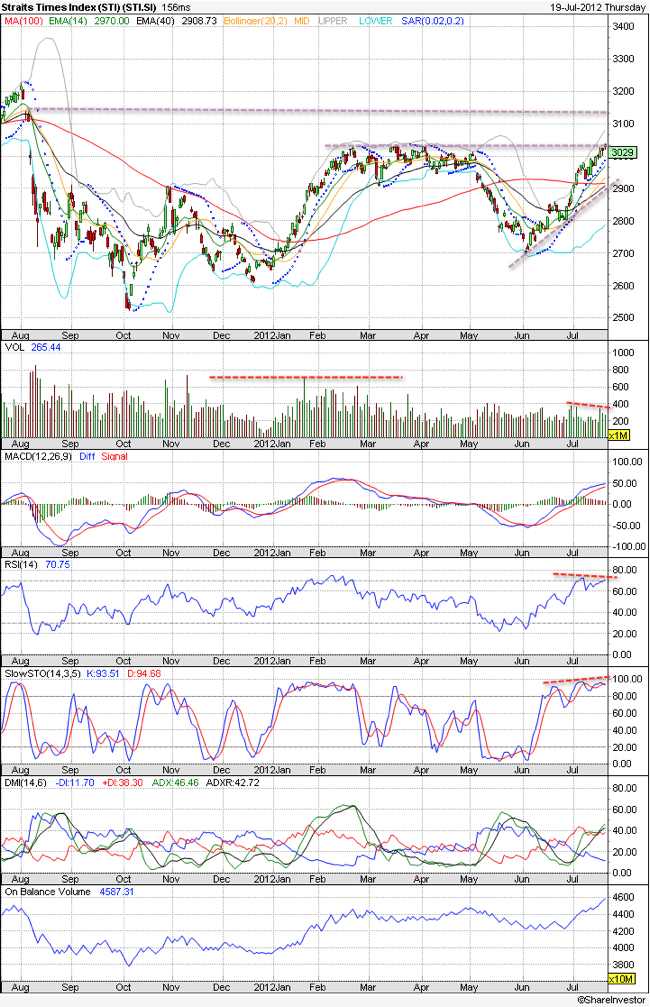

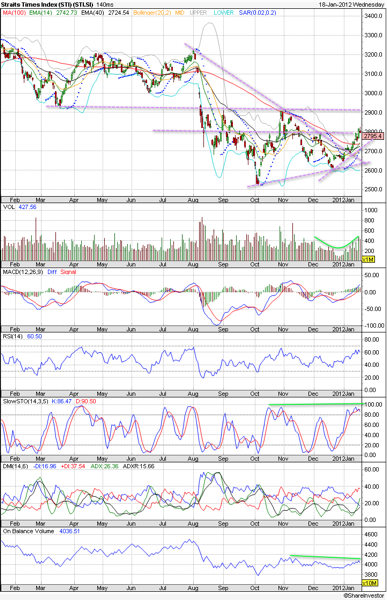

Ever since Jun 2012, our local Singapore bourse has been out performing vs the foreign markets despite lack of concrete improvement of the Euro crisis. Series of lackluster US economic data further add to the risk of a near term correction in the Singapore stock market. Looking at the STI technicals. it is now testing the very key resistance at…

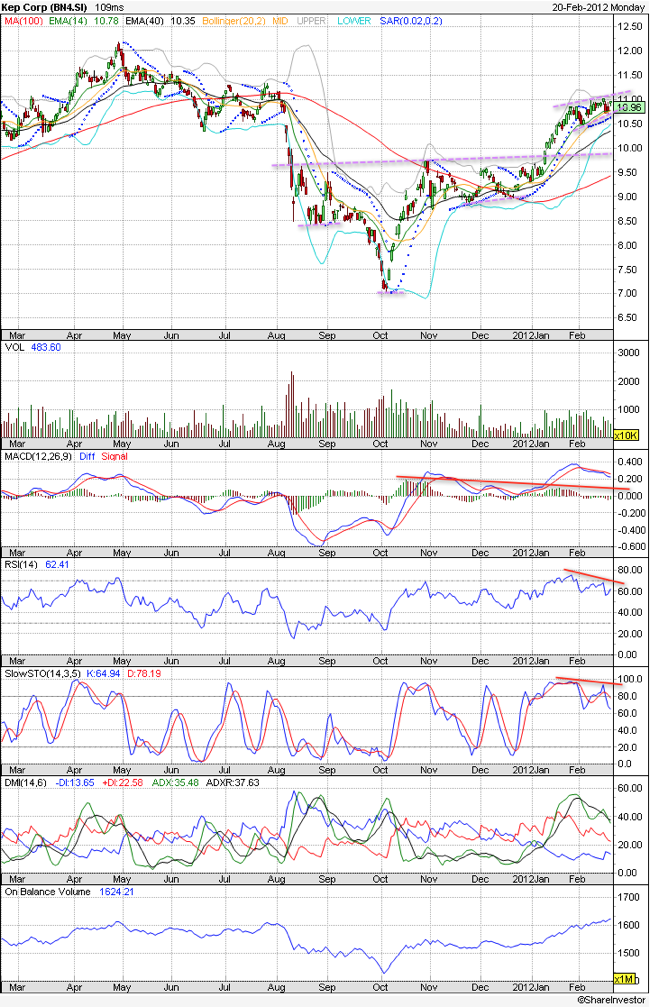

Impact of falling oil prices on Offshore & Marine stocks | KepCorp, SembMarine | Singapore Stocks Analysis

As of last week, world crude oil prices have dropped to the lowest price in eight months after U.S. stockpiles unexpectedly increased and a report signaled China’s manufacturing will shrink in Jun 2012. At one stage, oil fell nearly $3 on Thurs (21 Jun) to dip below $80 for the first time since October 2011. Typically, oil price is prone…

Part 3 : Cyclical sectors as focus during market bottoming – Offshore & Marine (O&M) Stocks | Fundamental Analysis

This is the last sector of my special focus analysis on stock picks during market bottom – Offshore & Marine (O&M) stocks. O&M sector has great volatility due to high dependencies on economic activities & prices of oil. Thus it is important to focus on good Offshore & Marine (O&M) companies with big market capitalization. 5 stocks in particular are…

Part 2 : Cyclical sectors as focus during market bottoming – Commodities Stocks | Fundamental Analysis

In my earlier post (Banking Stocks), we look at the banking sector which is will be the first few to move during a market recovery from multi year lows. For this post, we look at the other potential sector – Commodities. For relatively cheaper valuation commodity stocks, we have Golden Agri, Sakari, Noble Group with good liquidity and strong…

Straits Times Index (STI) – consolidation continues with positive bias | Profit taking for a cheaper re-entry | Singapore Stocks Market

After the gap down for Singapore Straits Times Index in August 2011, the index underwent series of sideway consolidation. Support will be at 2600 and resistance will be at 2900. Mid term wise, the index is poised up though MFI shows that funds are not driving the recent gains. The index should continue its sideway consolidation with positive bias until…

Singapore Bank Stocks – Underperformed vs STI | Accumulate on further weakness | Technical Analysis

With the recent anxiety over Greece & Italy’s increased risk of not meeting their debt obligations with observed increased yield rates of their long term government bonds, there is renewed weakness in most banking stocks throughout the region. As seen in Singapore, Financial sector is seen to be underperforming against the overall STI as much as 4-8%. This is not…

Sheng Siong Group (SSG) – a dividend play during volatile periods | Stock Review | Singapore Stock Market

Sheng Siong Group (SSG) offers a good defensive play especially during volatile Singapore stock market conditions. It has strong fundamentals and healthy balance sheet. Key strengths/Prospects: 1) Supported by strong domestic demands & good marginsFresh produce contributes about 30% to its revenue, with strong gross profit margins ranging from 21% toas high as 30%.No matter its good or bad days,…