China MinZhong (K2N.SI) is one China based company listed in SGX which underwent such tremendous change of events in just one week. It all started on 26th Aug 2013 when Glaucus issued a report on suspicious operations within the company. It is also noticeable that the coverage by analyst steadily declined over the years even though the reported revenue is…

Tag: Fundamental Analysis

Apple stocks plunged 9% after announcing their Q1 2013 results – a bargain buy? | Fundamental Analysis | US Stocks

Apple (AAPL) just announced their fiscal 2013 Q1 results which came in ‘unspectacular’ against what traders were anticipating. Nevertheless, it is still a very decent report card if we do look into the details. Key performance summary: Revenue: $54.5 billion versus $54.58 billion expected EPS: $13.81 versus $13.34 expected Gross Margin: 38.6% versus 39.5% expected iPhone: 47.8 million versus 50…

SoftBank makes aggressive investment in Sprint – short term dilution but long term strategic move | M&A | Stock Market

One of Japan’s largest wireless carriers, SoftBank Corp is spending $20.1 billion to gain a foothold in one of the world’s biggest and most lucrative mobile markets. SoftBank Corp., Japan’s third-largest carrier, is taking a 70% stake in struggling U.S. carrier Sprint Nextel Corp. It would mark the largest-ever overseas acquisition by a Japanese company. Softbank Corp.’s $20 billion takeover…

US stock markets have run ahead of reality? | Fundamental Analysis | US Stock Market

All eyes are on Fed’s next move and whether there is further QE3. Already as it stands, the interest rates are low till 2013 and reported profits for most listed companies are racking in above and inline with analysts’ estimates. Looking closer into the macroeconomics trends (depicted below), the slowdown is still persistent but personally it does not truly warrant…

Investment in Social Media stocks – Quick overview and comparisons | Trading Analysis | US Stocks

The staggering popularity and explosive growth of social media sites like Facebook and Twitter has been a nothing short of phenomenal. For social media space, investors need to ask themselves three key questions: • Is each company building a sustainable platform?• What kind of five-year growth are they capable of achieving?• And what will profits look like when they reach…

DBS (D05.SI) shares plummets after intended acquisition of Bank Danamon – accumulate or sell off? | SG Stocks Review

On 2nd April 2012, DBS Group Holdings (D05.SI) made an announcement that it is acquiring a 67.4% stake in Bank Danamon for S$6.2b. DBS is largely held by Singapore’s state-run Temasek Holdings and mentioned that it will pay its parent company 45.2 trillion rupiah($4.9 billion) in new shares for its 67% stake and buy the remaining stock from other shareholders for 21.2…

McDonald’s (MCD) has a change in top management – business profitability should be intact | Accumulation on weakness | US Stock Market

On 23rd March 2012, Jim Skinner was set to retire from McDonald’s (MCD) after 41 years with the fast food giant, the last seven and a half as CEO. Skinner will be handing off to Don Thompson, the chief operating officer and former head of McDonald’s USA, on June 30. Thompson moved from engineering to operations after just a few years at…

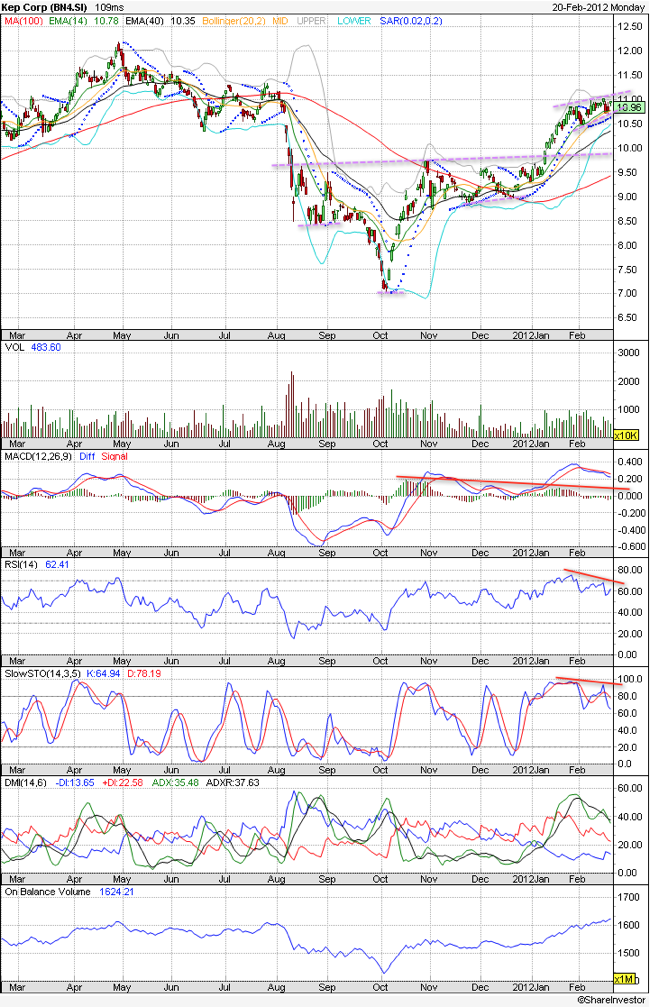

Part 3 : Cyclical sectors as focus during market bottoming – Offshore & Marine (O&M) Stocks | Fundamental Analysis

This is the last sector of my special focus analysis on stock picks during market bottom – Offshore & Marine (O&M) stocks. O&M sector has great volatility due to high dependencies on economic activities & prices of oil. Thus it is important to focus on good Offshore & Marine (O&M) companies with big market capitalization. 5 stocks in particular are…

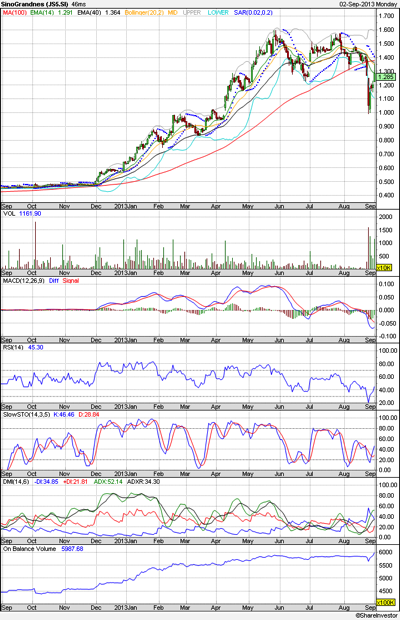

Part 2 : Cyclical sectors as focus during market bottoming – Commodities Stocks | Fundamental Analysis

In my earlier post (Banking Stocks), we look at the banking sector which is will be the first few to move during a market recovery from multi year lows. For this post, we look at the other potential sector – Commodities. For relatively cheaper valuation commodity stocks, we have Golden Agri, Sakari, Noble Group with good liquidity and strong…

Nokia (NOK) stock has been laggard – the worst is over? | Technical Analysis | US Stocks Market

Nokia (NOK) has been the leading handset maker since 1998 but after reaching its global goal of 40 percent market share in 2008, the Finnish company has been struggling against rivals making cheaper handsets in Asia. That sent Nokia’s global share to below 30 percent last year. Nokia comprises three business groups: Mobile Solutions, Mobile Phones and Markets. The company is…