RIM’s results of the past three months are $239 million, as compared to the $695 million in the previous quarter or $797 million at the same time, last year. This has triggered worries among investors, sending its stock price plummeting by 22% on intraday lows last Friday (16th September 2011). In order to have a decent financial profit turnaround, RIM…

Tag: Stock Review

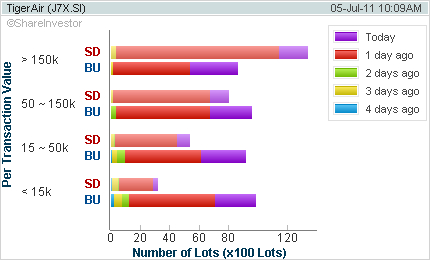

Tiger Airways – Near term impact and stock price weakness as opportunity? | Fundamental Analysis | Singapore Stock Market

On Fri 1st July 2011, the air safety watchdog Civil Aviation Safety Authority grounded all Australian domestic flights of a Tiger Airways subsidiary for the next week, saying the budget airline twice flew under the minimum allowed altitude. Tiger Airways, the fourth-largest domestic airline in Australia, operated between all state capitals and several regional cities. Tiger is 49 percent owned…

Osama Bin Laden is dead – How will Silver, Gold and Oil prices react? | Financial Review | Stocks & Commodities

On 2nd May 2011, one day after Singapore Labor Day, US President Obama officially announced that Osama Bin Laden was killed in a joint raid overnight Sunday in Pakistan’s northwestern district of Abbottabad, some 40 miles from Islamabad. The town also is home to a Pakistani military academy. Two American helicopters took part in the operation, the official said. One Pakistani…

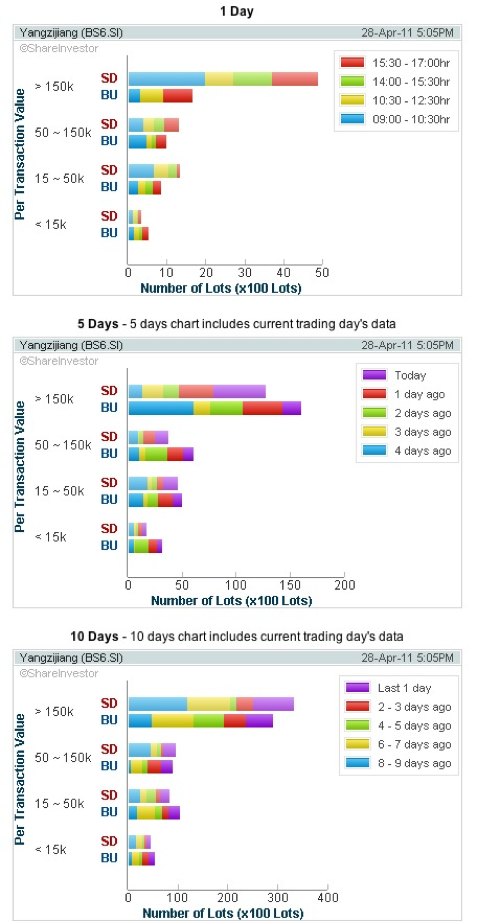

Yangzijiang Shipbuilding (BS6) reports good quarterly results but the prices are not as promising | Technical Analysis | Singapore Stock Market

Yangzijiang Shipbuilding (BS6) reported a 14% YoY rise in revenue to RMB3.05b and a 63% increase in net profit to RMB954.9m in 1Q11.The boost in net profit was mainly contributed by an increase in gross profit margin (27% in 1Q11 vs 23% in 1Q10) and higher other gains comprising mainly foreign exchange gains. 17 vessels were delivered in 1Q11, while…

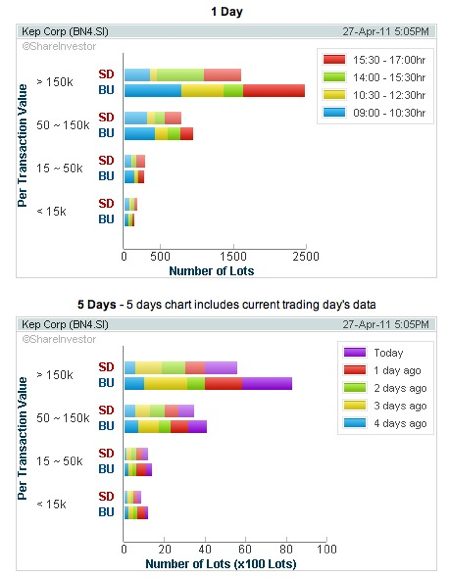

Keppel Corporation (KepCorp) – Rising star to weaken? | Technical Analysis | Singapore Stock Market

KepCorp has always been a blue chip darling since Oct where its stock price has been in uptrend since then from a value of $8.50 to as high as $12.90, representing a return of more than 50% within 6 months. Stock price are well supported by the moving averages and PSAR. Upward channel is still intact. However, when it still…

KepCorp – decent rise but underperform STI | Stock Prices | Singapore Stock Market

Singapore stocks have a good run up from last month lows. STI recovered a good 11% but KepCorp had only a mere 8%. It’s among the laggards as it’s stock price has breached resistance at $12 to attain 3 years high. Volume has not picked up to my expectations and both RSI, ADX are showing signs of weakening, though OBV…

Singapore Stock Exchange SGX – Start accumulation | Stocks Review | Singapore Stock Market

It was quite an eventful day for SGX between conversations of SGX CEO and Australia’s foreign investment regulator. This will shed some light in the long awaited outcome of the merger deal between SGX & ASX. Earlier this afternoon (5 April 2011, 1300hrs), Singapore Exchange Ltd. (S68.SG) Tuesday said it received notification from Australia’s foreign investment regulator that the Australian…

Straits Times Index STI – More weakness ahead – Stock Price / Stock Investment – Singapore Stock

The Straits TImes Index STI has breached multiple support in a span of one week, definitely a trend reversal. Funds are rushing out. DI+/DI- is widening with ADX rising. OBV is correcting downwards. Only consolation is to have a slight reprieve with RSI in oversold. 3080 as next support. Failure to hold, index will strike range (3000 – 3080). This…

Keppel Corporation (Kep Corp) – Accumulate on Weakness – Stock Price / Stock Investment – Singapore Stock Market

Price is on NHNL but MACD & RSI showing divergence. Price weakness to last for a while but has trong support towards S$11.6 and S$11.0. Based on last result earnings, true value at $14.00 which translates a upside potential of 30-40%. Follow us on: Share this article on:

Citigroup C – More short term downside – Stock Price / Stock Investment – US Stock Market

Price is now at crucial Bollinger support @ $4.66. If it breaks, HSH is possible with downside towards $4.5. Force index still at negative region with RSI not at bottom levels yet. Hold your bullets and regain towards $4.5+. Follow us on: Share this article on: