Amazon (AMZN) has released its new tablet reader – Kindle Fire, bringing a new competitor to a market that has so far been dominated by Apple. Based on a quick comparison charting on the various ket tablets available in the market, Amazon Fire has some competitive edge in terms of pricing with core decent specifications & mobility. More importantly, it…

Tag: Stock Price

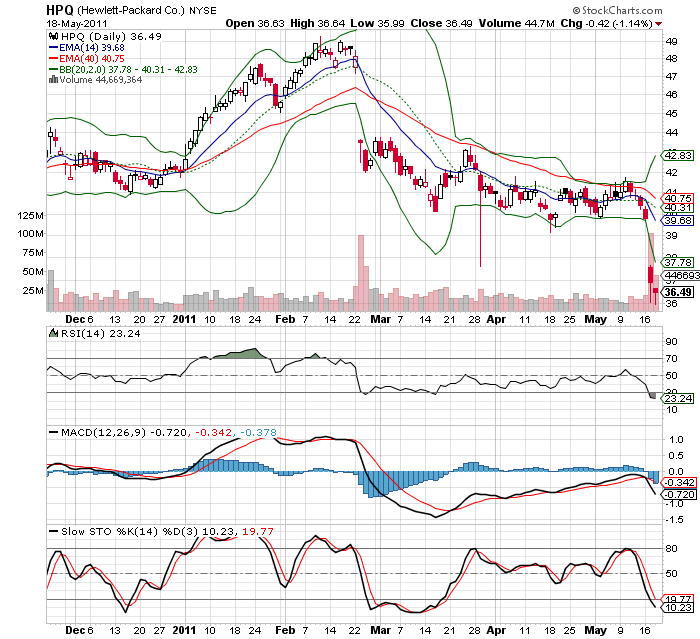

Hewlett-Packard Co H-P (HPQ) – financial forecast driven weakness or a good buying opportunity? | Technical Analysis Stock Prices | US Stock Market

On Tues 17th May 2011, Hewlett-Packard Co. reported a small increase in Q1 profit after a leak of a memo from the company’s CEO warning management of “another tough quarter.” The results for the quarter ended April 30 came in slightly above Wall Street’s expectations despite weakness in the company’s PC business and a slowdown in services. The shares had…

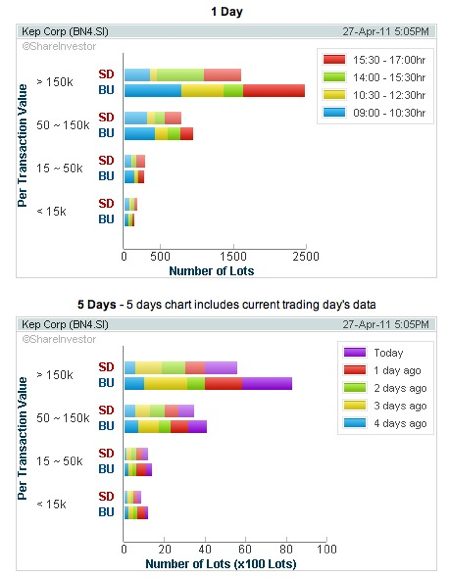

Keppel Corporation (KepCorp) – Rising star to weaken? | Technical Analysis | Singapore Stock Market

KepCorp has always been a blue chip darling since Oct where its stock price has been in uptrend since then from a value of $8.50 to as high as $12.90, representing a return of more than 50% within 6 months. Stock price are well supported by the moving averages and PSAR. Upward channel is still intact. However, when it still…

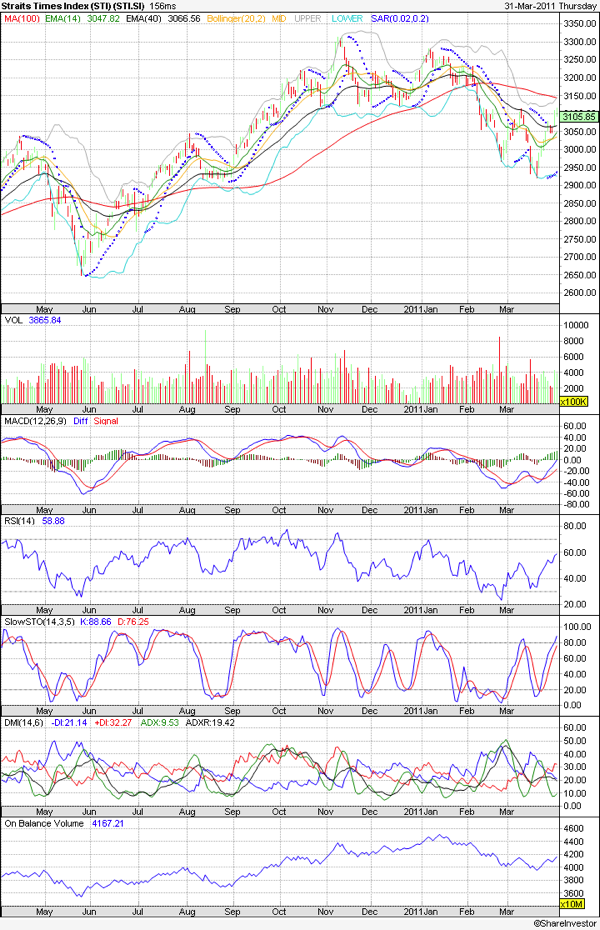

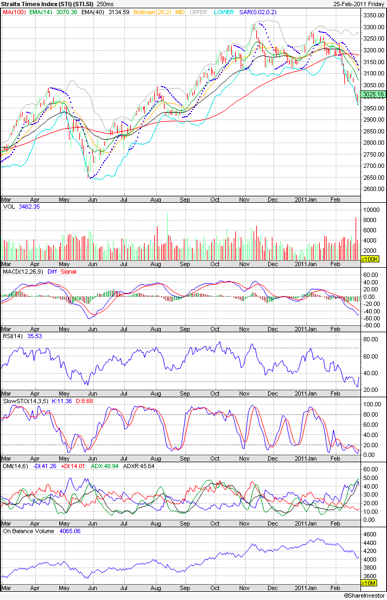

Straits Times Index STI, seeking for a new haven | Stock Market Review | Singapore

Singapore bourse has strongly rebounded from the recent double bottom near Bollinger band 2920 and went past crucial 3000 level recently. This is past 2 moving averages and STI is poised to resume bullish trend. Next important resistance will be at 3150. Volume has been good but not among the highest and this serve to show some investors are still…

Nike Inc. (NKE) suffered price decline after a weak quarterly profit | Stock Analysis | US Stock Market

Nike Inc.(NKE) reported on 18 Mar 2011, a smaller quarterly profit than most analysts had expected. Financial-wise: – Fiscal third-quarter net income of $523 million, or $1.08 a share, up from $497 million, or $1.01 a share, in the year-earlier period– Sales increased 7% to $5 billion– Gross margin fell 110 basis points to 45.8% as the cost to make…

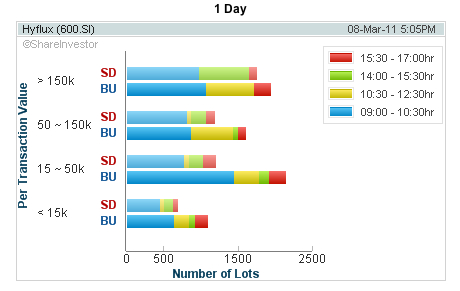

Hyflux (600) – Short Term Reversal, Buy | Stock Prices | Singapore Stock Market

Hyflux stock surged a good 12% from previous day close. There is a series of Buy calls from various broking firms (DBS Vickers, Kim Eng) and after winning for Singapore’s second desalination plant at Tuas. Technical wise, Hyflux failed to breach top resistance of $2.4 during Jan 2011 and thereafter it corrected downwards through multiple Moving Averages. As anticipated, the…

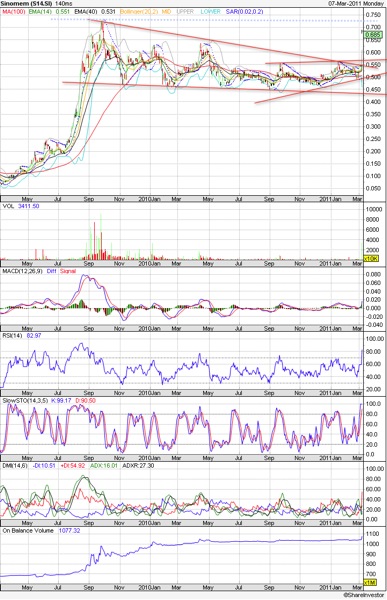

Sinomen Technology (S14.SG) | Surge with takeover | Stock Market & Investment | Singapore

Prices of Sinomen Technology surged & gap up today on the nes of its takeover by Clean Water Investment at S$0.70 per share (31.6% premium to Sinomen’s NAV/Share) and 28.4% premium. Key resistance will be at 0.725 which represent upside at only 6%. Accumulate at consolidation towards S$0.65 will be favorable. Key support will now be at $0.575. OBV has…

Golden Agri – Bottom formation | Stock Prices & Investment | Singapore Market

As forecasted, with the general political instability and rising oil prices, most Singapore stocks suffered a rapid correction since Jan 2010. Golden Agri also suffered reversal from the peak of $0.83 all the way piercing through several MA support lines and reach a bottom support of $0.61. A visible bullish engulfing candlestick formation was formed and the prices have recovered…

Dow Jones, STI and US/SG stock market analysis | Stock Market & Investment | US, Singapore

Since weeks back, I have cautioned all to be nimble about stock market movements lead by the rising negative developments in Libya unrest. Oil production has been disrupted causing oil futures to surge to record high since 2009 and investors rushing into safe haven via USD & Yen, prompting rising strength in both. The latest comforting news are worth to…

KepCorp – Mid term uptrend intact – Singapore Stock Price / Market

With new book orders, it is one of the good stock which bucked the downward trend of STI main stock components. Near term there should be some further consolidations before the price breakout of S$12. For good risk appetite investors, you can consider accumulating on weakness. Follow us on: Share this article on: