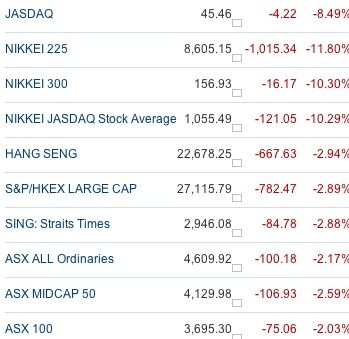

As predicted in my past blog entries, Japan has suffered the 3rd worst intraday price plunge in her history for the Nikkei 225 Index. Stock markets round the world are also not spared:

A) Asian Stock Markets:

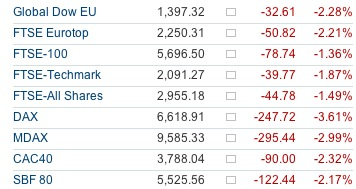

B) European Stock Markets:

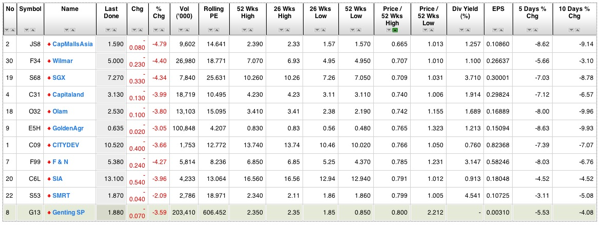

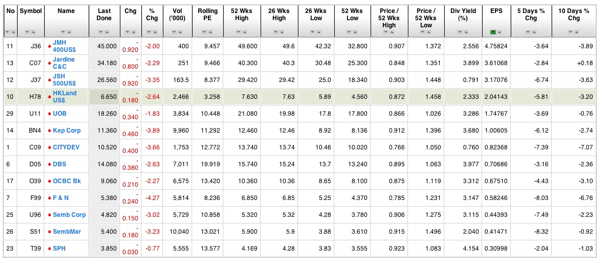

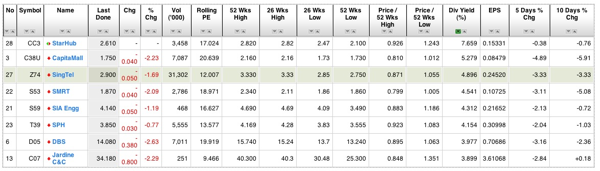

Likewise, for Singapore Stock Market, the STI has breeched 3000 psychological level to end at 2946.1 (-2.8%). Looking at individual STI component stocks performance against the STI plunge, one can spot some potential value buys.

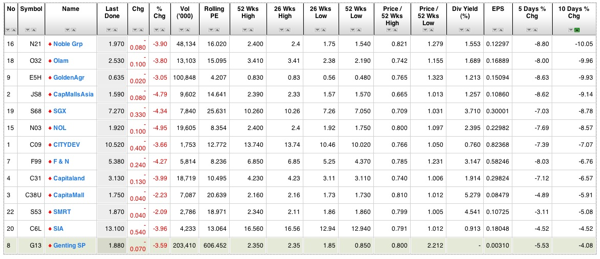

Gauging stocks which:

1) Underperformed and suffered great corrections (e.g. Price from its 52 weeks high):

2) Has the greatest % price changes since 10 days ago:

3) Has the largest Earning Per Share (EPS):

4) Has good dividend yields:

In a volatile economic situation, it pays well and be prudent to invest in Blue Chips with good order books and good declared EPS. And it would seem that banks, rig/marine & high div yield stocks are ideal. Scrutinizing them further, the best play for Banks will be OCBC. For Rig/Marine, it will be KepCorp. And lastly for good dividend plays, it will be CapitaMall. All of these are based on degree of price corrections vs its peers.

Stay tuned for my subsequent posts on Technical Analysis on good entries and exits for these recommendations.

Read other related posts:

Follow us on:

Share this article on: