On Fri 1st July 2011, the air safety watchdog Civil Aviation Safety Authority grounded all Australian domestic flights of a Tiger Airways subsidiary for the next week, saying the budget airline twice flew under the minimum allowed altitude.

Tiger Airways, the fourth-largest domestic airline in Australia, operated between all state capitals and several regional cities. Tiger is 49 percent owned by national carrier Singapore Airlines Ltd. and 11 percent owned by state-owned investment company Temasek Holdings

Yesterday 4th July 2011, Tiger Airways shares, ended the day lower by 19 cents or 16% at S$1.00 yesterday. The stock came under selling pressure yesterday, with some 61.84 million shares changing hands.

The estimated cost of impact from the suspension was S$2mil per week.

There is also market talk that a prolonged suspension of the airline’s operation in Australia may result in the airline scaling back its operations there or possibly shutting it down completely.

Phillip Securities said the impact of a week’s suspension might not be substantial as the airline’s Australian operations generated S$279mil of sales last year and the Australian operations had not been a source of profit to the group’s bottom line as it had been bleeding for the last four years.

Sources indicated Tiger Airways CEO Tony Davis, earlier sold 1,000,000 shares or 24.3% of his holdings at S$1.42. This was below the issue price of S$1.50.

CMIB last downgraded their FY12-14 EPS forecasts by 11-15% to incorporate lower load factors and higher operating costs. They also cut their P/E target from 8x to 6x, reducing target price from S$1.40 to S$0.92.

The stock price has been dismal from Oct 2010, breaking through all support and moving averages. The immediate resistance will be at $1.1 and next support will be at $0.90.

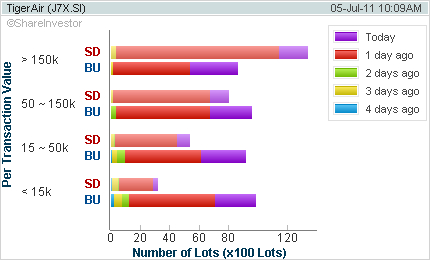

Funds are selling big time while retail investors are bargain hunting. It is definitely wise to stay sidelines until the suspension is over and greater clarity in direction from management at this moment.

Read other related posts:

Follow us on:Share this article on: