STI has been consolidating since Aug 2013 within a tight band. Current support is at 3080 & its resistance at 3180.

Momentum is also slowing with bearish divergence forming at both volume & MACD indicators.

More convincing breakout should happen beyond 3200.

Quick look at some key FTSE ST Indices:

A) FTSE ST Financials Index (FSTAS8000.SI)

– Short term movement : consolidating (Current: 793.43 Support: 770, Resistance: 800)

– Momentum : Overbought

– Average trading volume : lacklustre

– OBV : stagnant

– Key stocks in this sector (by market cap) : DBS, OCBC, UOB, GreatEast, SGX, HL Fin, ValueMax

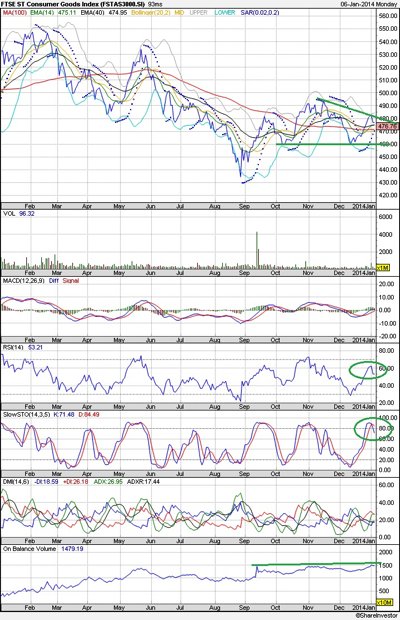

B) FTSE ST Consumer Goods Index (FSTAS3000.SI)

– Short term movement : consolidating (Current: 476.76 Support: 460, Resistance: 480)

– Momentum : slight overbought

– Average trading volume : lacklustre

– OBV : uptrend

– Key stocks in this sector (by market cap) : Wilmar, GoldenAgr, Noble Grp, Olam, FirstRes, Bumitama

C) FTSE ST Oil & gas Index (FTSA0001.SI)

– Short term movement : uptrend consolidation (Current: 770.43 Support: 745, Resistance: 772)

– Momentum : overbought

– Average trading volume : constant

– OBV : uptrend

– Key stocks in this sector (by market cap) : EzionHldg, Ezra, Kris Energy, Linc Energy

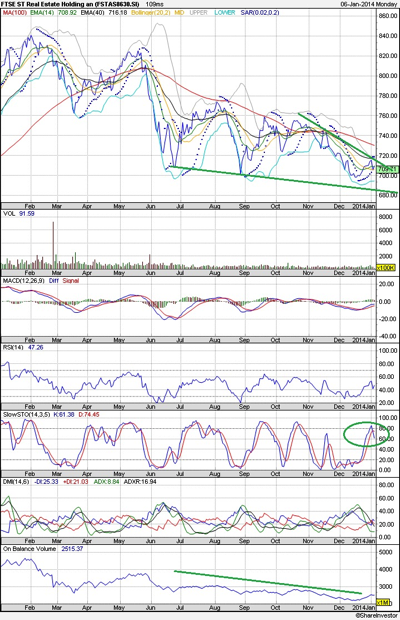

D) FTSE ST Real Estate Holding & Investments Index (FTSA8630.SI)

– Short term movement : downtrend consolidation (Current: 709.71 Support: 685, Resistance: 710)

– Momentum : nil

– Average trading volume : low

– OBV : downtrend

– Key stocks in this sector (by market cap) : HKLand, CapitaLand, CityDev, CapMallsAsia, KepLand, UOL

Long term investors should await better entry conditions especially when STI corrects towards key resistance.

Read other related posts:

Follow us on:Share this article on: