On 27th Jul 2011, Marina Bay Sands (MBS) reported 2Q11 results which exceeded our and market expectation of a seasonally softer rolling chip volume 2Q11. 2Q11’s strong growth in rolling chip volume bodes well for the industry, and implies good long-term prospects for both the industry and rival Resorts World Sentosa (RWS) as VIP gamers typically patronise both casinos. Parent…

Tag: Singapore Stocks

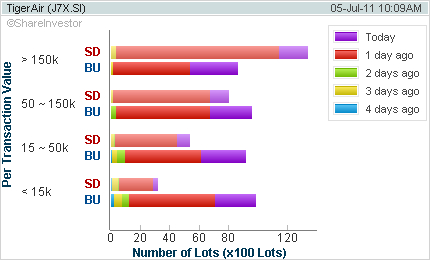

Tiger Airways – Near term impact and stock price weakness as opportunity? | Fundamental Analysis | Singapore Stock Market

On Fri 1st July 2011, the air safety watchdog Civil Aviation Safety Authority grounded all Australian domestic flights of a Tiger Airways subsidiary for the next week, saying the budget airline twice flew under the minimum allowed altitude. Tiger Airways, the fourth-largest domestic airline in Australia, operated between all state capitals and several regional cities. Tiger is 49 percent owned…

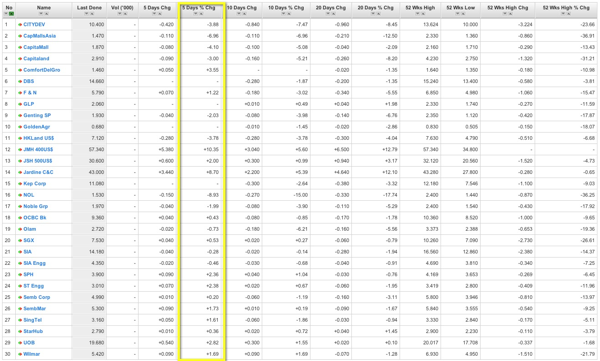

Straits Times Index poised for a good consolidation breakout | STI & Component Stocks | Singapore Stock Market

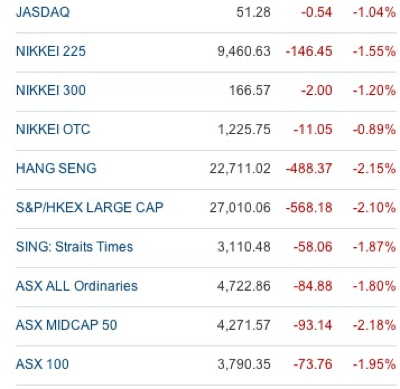

On Wednesday the Greek parliament approved austerity measures to avoid default. Lawmakers in Athens on Thursday approved implementation of the plan insisted upon by European officials. With this economic backdrop, the general market sentiments have improved across the world. The recent US economic figures have also shown stability and slight improvements. These have encouraged the sideliners to be back into…

Strong Singapore GDP growth clouded by Greece bailout risks | Fundamental Analysis | Singapore Stock Market and STI

On Wednesday 22nd June 2011, Greek Prime Minister George Papandreou’s government survived a confidence vote in parliament. This piece of news has injected the needed confidence among the investors who underwent financial market turmoils for the past few weeks. European leaders breathed a sigh of relief but kept up the pressure on Greek Prime Minister George Papandreou, who faces a vote…

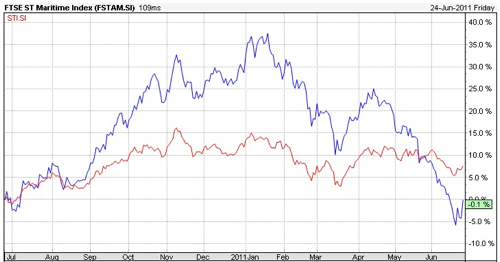

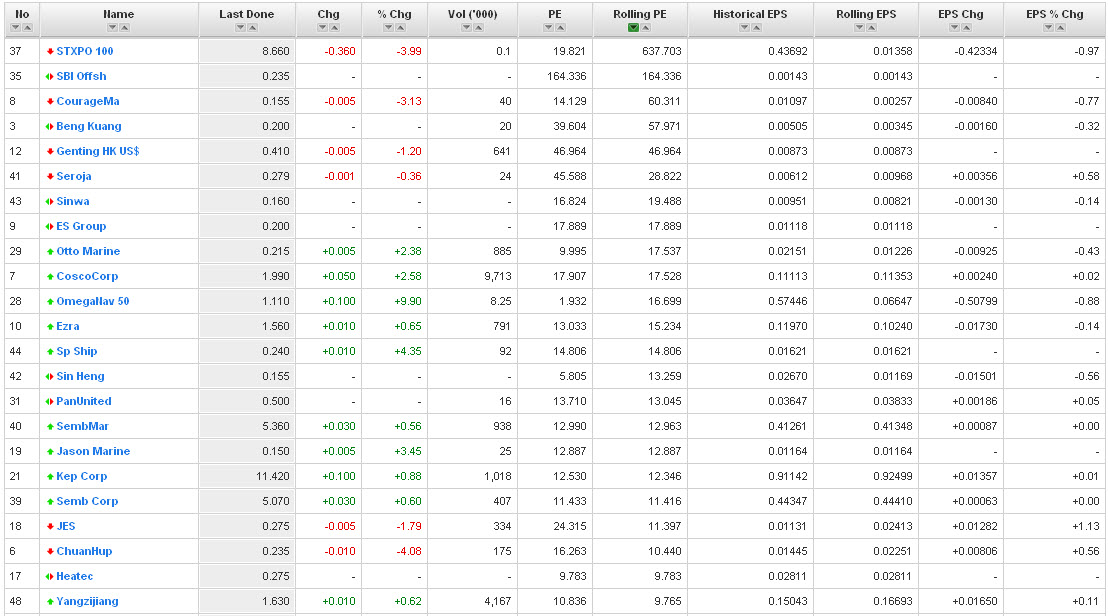

Marine / Rig / Shipping stocks underperform against STI? | Stock Prices Technical Analysis | Singapore Stock Market

It is the last day of a dreaded month of May for 2011. Historically, this month is avoided by retail investors as it is a month of volatility and consolidation. Not aided by the undesirable impact of series of downgrades in various faltering European countries e.g. Spain and a slowdown in greater China market and Singapore latest GDP results do…

European crisis and China economy slowdown have increased risk aversion | STI, Cosco, Yangzijiang stock prices | US, Singapore Stock Markets

Once again, it was a ‘red’ Monday with all stock markets not spared from the brutal selldowns. Though traditionally, May period is known to most experienced investors as a month of ‘short’ or ‘sell’, this time round, the new anxiety and fear is a result of some key economic developments in UK and China. On Friday (20th May 2011), Fitch…

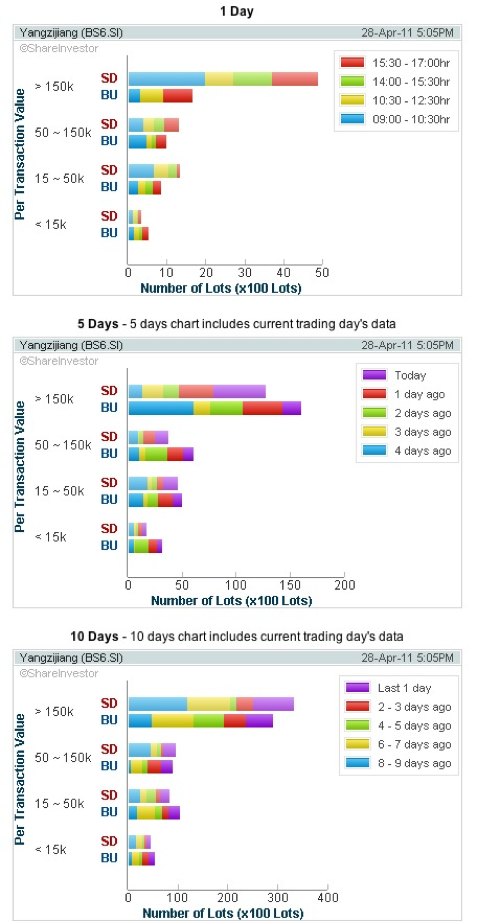

Yangzijiang Shipbuilding (BS6) reports good quarterly results but the prices are not as promising | Technical Analysis | Singapore Stock Market

Yangzijiang Shipbuilding (BS6) reported a 14% YoY rise in revenue to RMB3.05b and a 63% increase in net profit to RMB954.9m in 1Q11.The boost in net profit was mainly contributed by an increase in gross profit margin (27% in 1Q11 vs 23% in 1Q10) and higher other gains comprising mainly foreign exchange gains. 17 vessels were delivered in 1Q11, while…

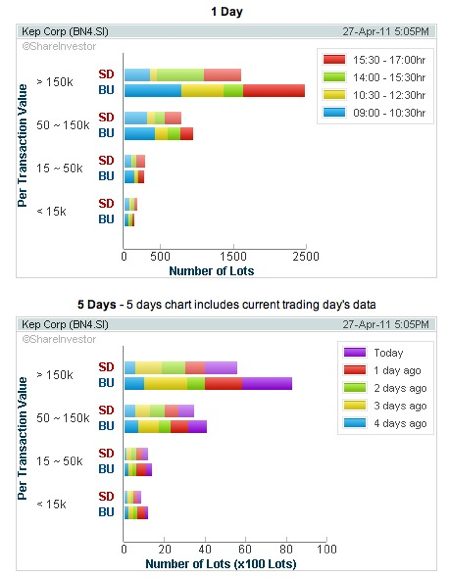

Keppel Corporation (KepCorp) – Rising star to weaken? | Technical Analysis | Singapore Stock Market

KepCorp has always been a blue chip darling since Oct where its stock price has been in uptrend since then from a value of $8.50 to as high as $12.90, representing a return of more than 50% within 6 months. Stock price are well supported by the moving averages and PSAR. Upward channel is still intact. However, when it still…

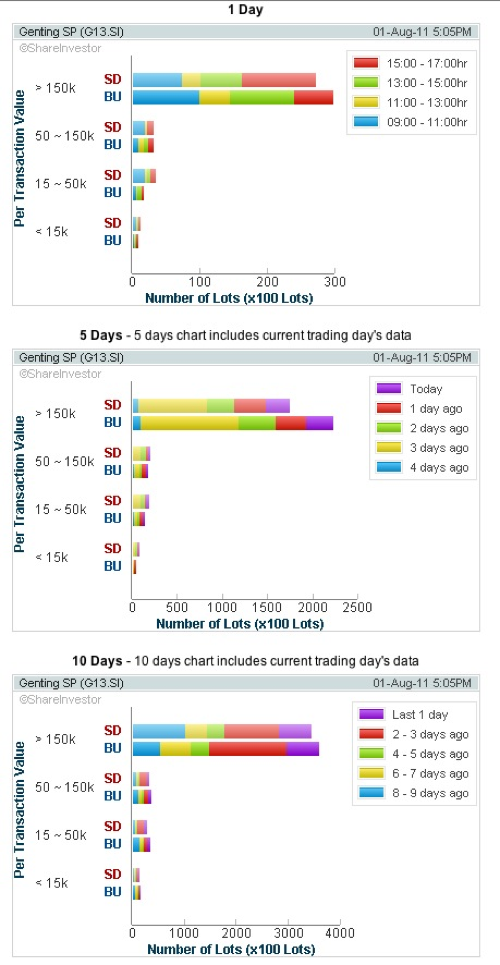

Genting.SP has more price consolidations ahead | Stocks Review | Singapore Stocks Market

Ever since the Genting stock price touched its historical high of S$2.34, it has then undergone a series of downward consolidation within $0.200 price channel. The recovery from the 3 months low from S$1.85 provided some hope to breakout of the consolidation channel but the divergences in both its daily volume and MACD were signs of disappointment. Watch out if…

Straits Times Index STI – More weakness ahead – Stock Price / Stock Investment – Singapore Stock

The Straits TImes Index STI has breached multiple support in a span of one week, definitely a trend reversal. Funds are rushing out. DI+/DI- is widening with ADX rising. OBV is correcting downwards. Only consolation is to have a slight reprieve with RSI in oversold. 3080 as next support. Failure to hold, index will strike range (3000 – 3080). This…