US stocks climbed and treasuries tumbled on last Thursday after the second EU summit in six days of talks ended in Brussels with European governments boosting their rescue fund to 1 trillion euros. Europe’s latest effort to contain the euro zone’s two-year-old debt crisis won applause from financial markets. It includes a commitment by banks and other private bondholders to accept…

Tag: Fundamental Analysis

Sheng Siong Group (SSG) – a dividend play during volatile periods | Stock Review | Singapore Stock Market

Sheng Siong Group (SSG) offers a good defensive play especially during volatile Singapore stock market conditions. It has strong fundamentals and healthy balance sheet. Key strengths/Prospects: 1) Supported by strong domestic demands & good marginsFresh produce contributes about 30% to its revenue, with strong gross profit margins ranging from 21% toas high as 30%.No matter its good or bad days,…

Blackberry maker RIM releases poor financial results, stock price falls – a value play? | US Stocks Review

RIM’s results of the past three months are $239 million, as compared to the $695 million in the previous quarter or $797 million at the same time, last year. This has triggered worries among investors, sending its stock price plummeting by 22% on intraday lows last Friday (16th September 2011). In order to have a decent financial profit turnaround, RIM…

HP (HPQ) stock price falls amid analysts’ downgrades on weak investors’ confidence in new business directions | US Stock Market

Last Friday (19th Aug 11), the technology giant, HP (HPQ) shed about $12 billion of its market value as more than half a dozen Wall Street analysts downgraded its stock, citing a litany of concerns over the company’s ability to reinvent itself. Friday’s drop of $5.91, to $23.60 a share, came a day after HP said it would seek to…

Keppel Corp (KepCorp) – Stock with good valuation amidst weak market sentiments | Accumulate on price weaknesses | Singapore Stocks Review

Keppel Corp (KepCorp) is among the Singapore Blue Chips which was highlighted in my previous post on good valued stocks to keep a watch out during this financial volatility. Keppel Corp is a Singapore-based conglomerate with businesses engaged in rig-building, utility operation, and property development/investment. The company is one of the world’s largest rig-builders in terms of global market share.…

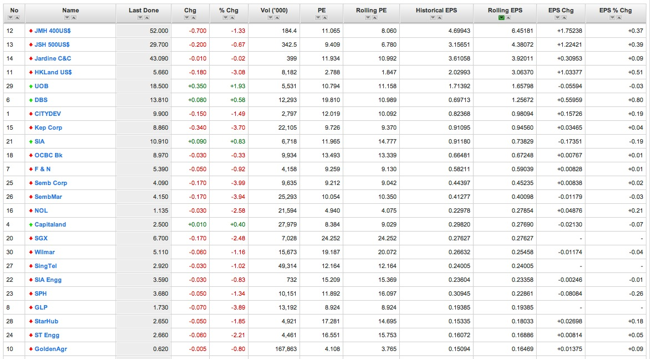

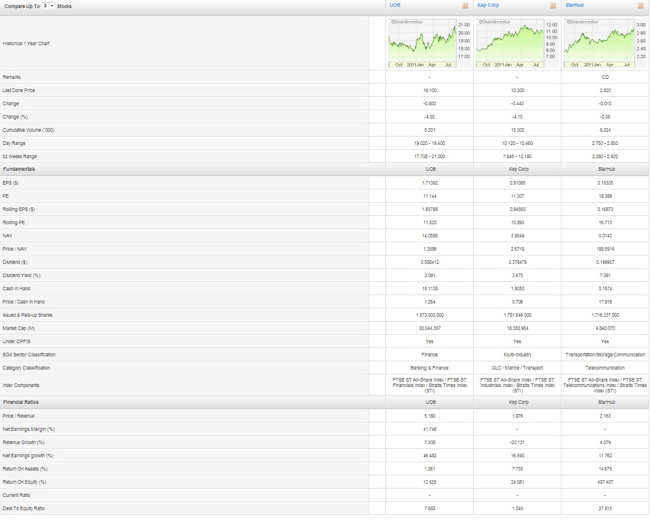

Stock Picks – Good bargain Singapore Stocks for buying and slow accumulation on price weaknesses | Fundamental Analysis | Singapore Stock Market

Stock market crashed multiple times in entire history and being humans we are always affected by fear & anxiety. We will ask the same question whenever it happens – “Will it go lower?”, “It is only the start…?”, “What’s wring with everyone?”, “When can we enter?” … Like any other technical and fundamental (2in1) analyst, we have the advantage to…

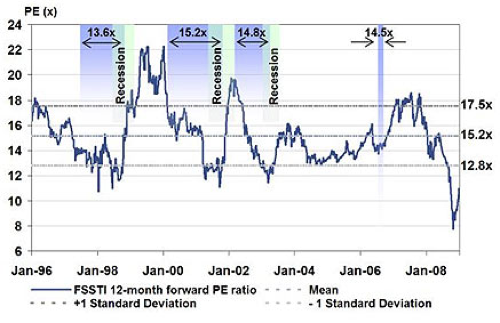

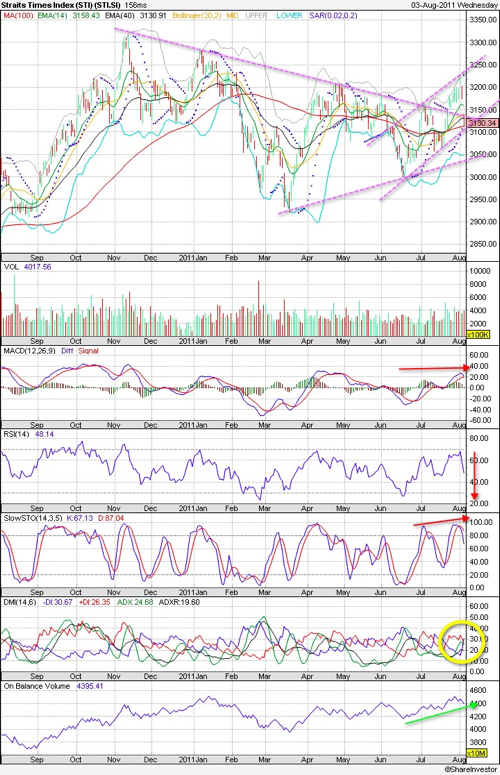

Straits Times Index – when to buy or enter at cheap valuation level? | Technical Analysis | Singapore Stock Markets

As expected after the S&P downgrade of US debt long term from AAA to AA+ over the weekend, all Asian markets crashed on Mon (8th August 2011). At one stage, the Straits Times Index tanked as much as 5%+ but recovered to 2884 at end of day session. It brings us to the million-dollar question : how long will the…

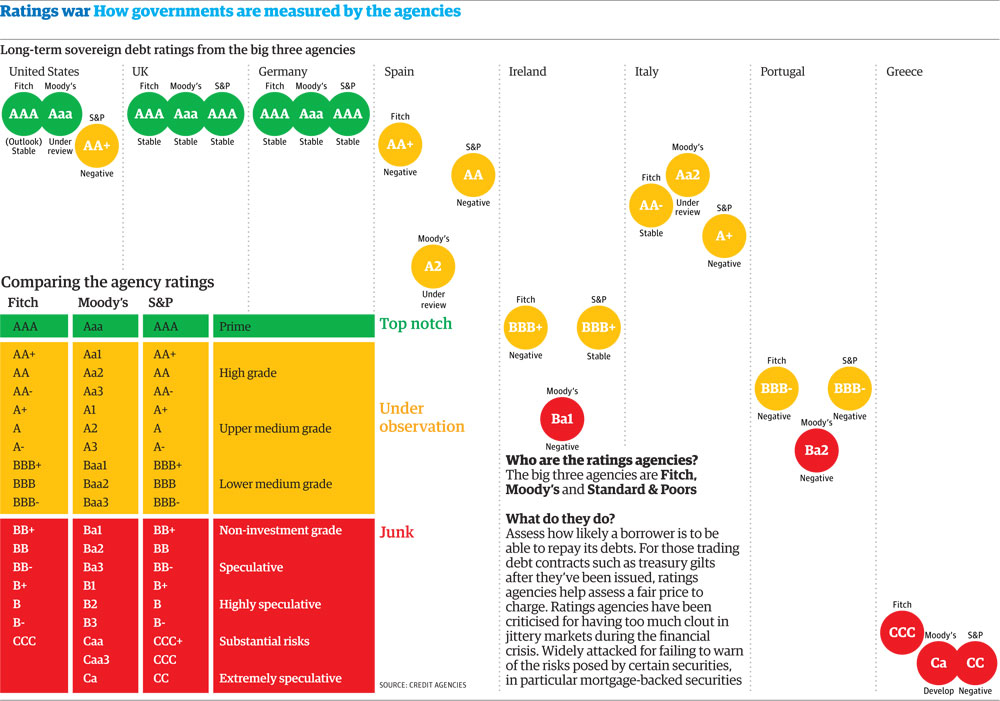

S&P downgrades US from AAA to AA ratings – poor US credit rating with worsening budget deficits | Fundamental Analysis | US

The world ended the week with a tailspin from S&P downgrade of the triple-A (AAA) rating the US has held for 70 years, saying the budget deal recently brokered in Washington didn’t do enough to address the gloomy long-term picture for America’s finances Standard & Poor’s slammed the nation’s political process and criticizing lawmakers for failing to cut spending enough…

Finding silver lining among Stock Market major declines and increase risk aversion | Fundamental Analysis | Global Stocks Market

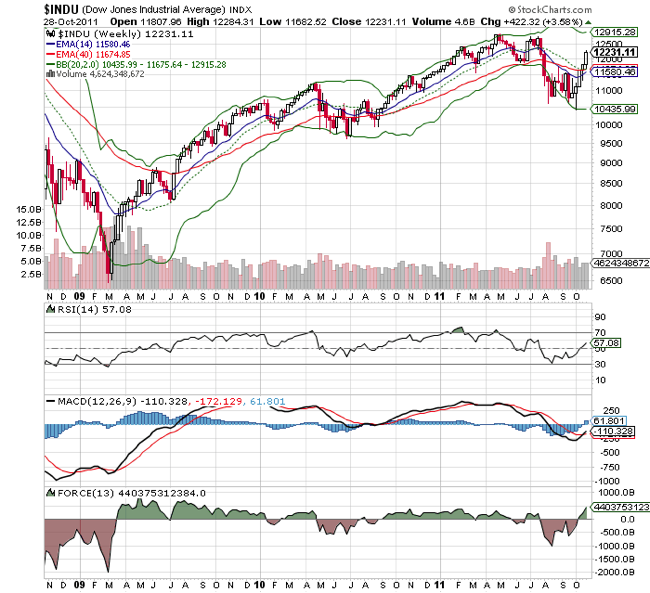

On Thurs (8th Aug 2011), the three benchmark stock indexes (Dow Jones Industrial, Nasdaq and S&P) all crashed into negative territory for the year. Oil also dropped sharply on thoughts of reduced global demand and even the safe haven gold sank as investors cut holdings to cover stock positions. Naturally, Treasurys and the dollar rallied. By then end of Thursday US…

House of Republicans and Senate approved raise of US Debt Ceiling but market waivers with risk of US rating cuts | Fundamental Analysis | US Stock Market

Last night (2nd Aug 2011), the Senate finally approved a proposal (74 to 26 votes) that increases the $14.3 trillion debt limit by up to $2.4 trillion in two stages, and by the Congressional Budget Officeís tally, reduces deficits by $2.1 trillion over a decade. Yet even with the cuts, the United States is projected to increase the national debt by…