Amazon (AMZN) has released its new tablet reader – Kindle Fire, bringing a new competitor to a market that has so far been dominated by Apple. Based on a quick comparison charting on the various ket tablets available in the market, Amazon Fire has some competitive edge in terms of pricing with core decent specifications & mobility. More importantly, it…

Tag: Technical Analysis

Gold futures, SPDR Gold shares – buy / accumulate on short term price weakness | Technical Analysis | US Commodities

For the earlier part of this week and previous week, the bourses suffered another bearish continuations with some markets hitting multi year lows. Commodities and gold were equally not spared. Despite being viewed as safe haven, Gold suffered one of there worst decline in a week due to a combination of these factors: 1) Strengthening USD against major currencies 2)…

Apple stock (AAPL), Dow Jones Industrial, Nasdaq Composite are reaching key resistance – buy into strength or take profits? | US Stock Markets

This week is fraught will series of uncertainties – Greece default issues, S&P’s downgrade of Italy credit ratings, strengthening of USD as a safe haven etc. This has resulted an increased volatility in stock prices. But are we at the bottom of the movements for some bargain hunting? Or its the calm before another storm? Dow Jones Industrial Average The…

Blackberry maker RIM releases poor financial results, stock price falls – a value play? | US Stocks Review

RIM’s results of the past three months are $239 million, as compared to the $695 million in the previous quarter or $797 million at the same time, last year. This has triggered worries among investors, sending its stock price plummeting by 22% on intraday lows last Friday (16th September 2011). In order to have a decent financial profit turnaround, RIM…

Nasdaq halted its rally in face of weak US jobs data | Technology stocks to face short term selling pressures | US Stock Market

On Friday 2nd Sept, U.S. Labor Department reported no job growth in the nation last month, pressuring energy demand forecasts and prices even as a tropical storm in the Gulf of Mexico prompted precautionary rig evacuations. The Labor Department reported payrolls were unchanged on the month, while the jobless rate held at 9.1%, as the first downgrade of the country’s…

Straits Times Index surges as sentiments improves | Take Profits or Buy into Strength? | Singapore Stock Market

Singapore stock market was once again sizzling after a Hari Raya holiday break. On the last day of the month, the benchmark Straits Times Index was up 93.37 points to close at 2,885.26. Gainers outnumbered losers 513 to 89. A total of 2.28 billion shares, valued at $2.44 billion, changed hands. The strength in the day volume signify the return of…

HP (HPQ) stock price falls amid analysts’ downgrades on weak investors’ confidence in new business directions | US Stock Market

Last Friday (19th Aug 11), the technology giant, HP (HPQ) shed about $12 billion of its market value as more than half a dozen Wall Street analysts downgraded its stock, citing a litany of concerns over the company’s ability to reinvent itself. Friday’s drop of $5.91, to $23.60 a share, came a day after HP said it would seek to…

Keppel Corp (KepCorp) – Stock with good valuation amidst weak market sentiments | Accumulate on price weaknesses | Singapore Stocks Review

Keppel Corp (KepCorp) is among the Singapore Blue Chips which was highlighted in my previous post on good valued stocks to keep a watch out during this financial volatility. Keppel Corp is a Singapore-based conglomerate with businesses engaged in rig-building, utility operation, and property development/investment. The company is one of the world’s largest rig-builders in terms of global market share.…

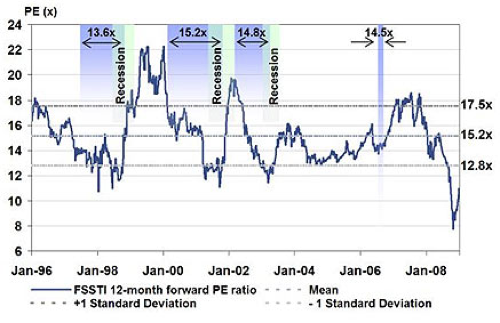

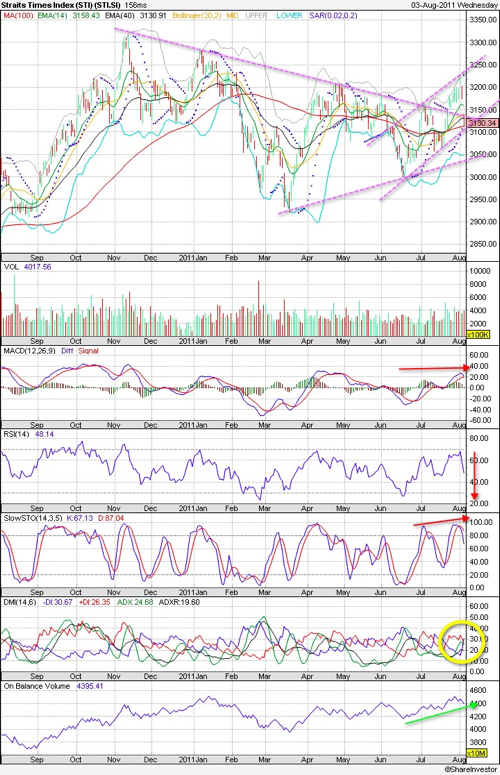

Straits Times Index – when to buy or enter at cheap valuation level? | Technical Analysis | Singapore Stock Markets

As expected after the S&P downgrade of US debt long term from AAA to AA+ over the weekend, all Asian markets crashed on Mon (8th August 2011). At one stage, the Straits Times Index tanked as much as 5%+ but recovered to 2884 at end of day session. It brings us to the million-dollar question : how long will the…

House of Republicans and Senate approved raise of US Debt Ceiling but market waivers with risk of US rating cuts | Fundamental Analysis | US Stock Market

Last night (2nd Aug 2011), the Senate finally approved a proposal (74 to 26 votes) that increases the $14.3 trillion debt limit by up to $2.4 trillion in two stages, and by the Congressional Budget Officeís tally, reduces deficits by $2.1 trillion over a decade. Yet even with the cuts, the United States is projected to increase the national debt by…