The staggering popularity and explosive growth of social media sites like Facebook and Twitter has been a nothing short of phenomenal. For social media space, investors need to ask themselves three key questions: • Is each company building a sustainable platform?• What kind of five-year growth are they capable of achieving?• And what will profits look like when they reach…

Category: Investment Tips & Guides

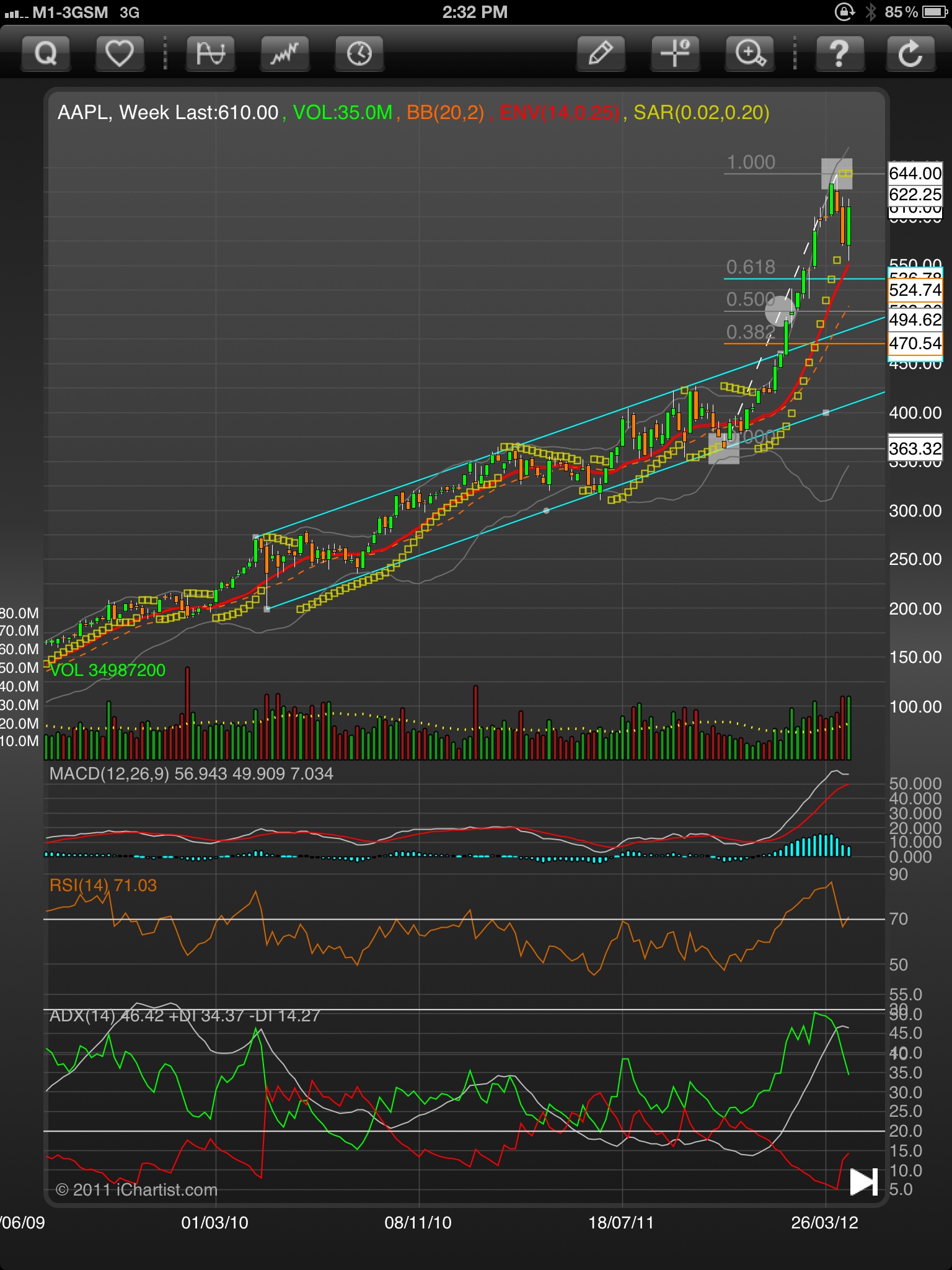

Stock prices chasing the good Apple earnings? – accumulation on dips | US Stocks

During the Apple (AAPL) Q2 2012 earnings call yesterday, Apple announced that it sold 35.1 million iPhones, 11.8 million iPads, 7.7 million iPods and 4 million Macs. During the same period, its earnings also saw similar massive growth of 92% in Q1 2011 and that of Q1 2012 growth of 94%. The iPad is growing at a faster rate than the…

DBS (D05.SI) shares plummets after intended acquisition of Bank Danamon – accumulate or sell off? | SG Stocks Review

On 2nd April 2012, DBS Group Holdings (D05.SI) made an announcement that it is acquiring a 67.4% stake in Bank Danamon for S$6.2b. DBS is largely held by Singapore’s state-run Temasek Holdings and mentioned that it will pay its parent company 45.2 trillion rupiah($4.9 billion) in new shares for its 67% stake and buy the remaining stock from other shareholders for 21.2…

McDonald’s (MCD) has a change in top management – business profitability should be intact | Accumulation on weakness | US Stock Market

On 23rd March 2012, Jim Skinner was set to retire from McDonald’s (MCD) after 41 years with the fast food giant, the last seven and a half as CEO. Skinner will be handing off to Don Thompson, the chief operating officer and former head of McDonald’s USA, on June 30. Thompson moved from engineering to operations after just a few years at…

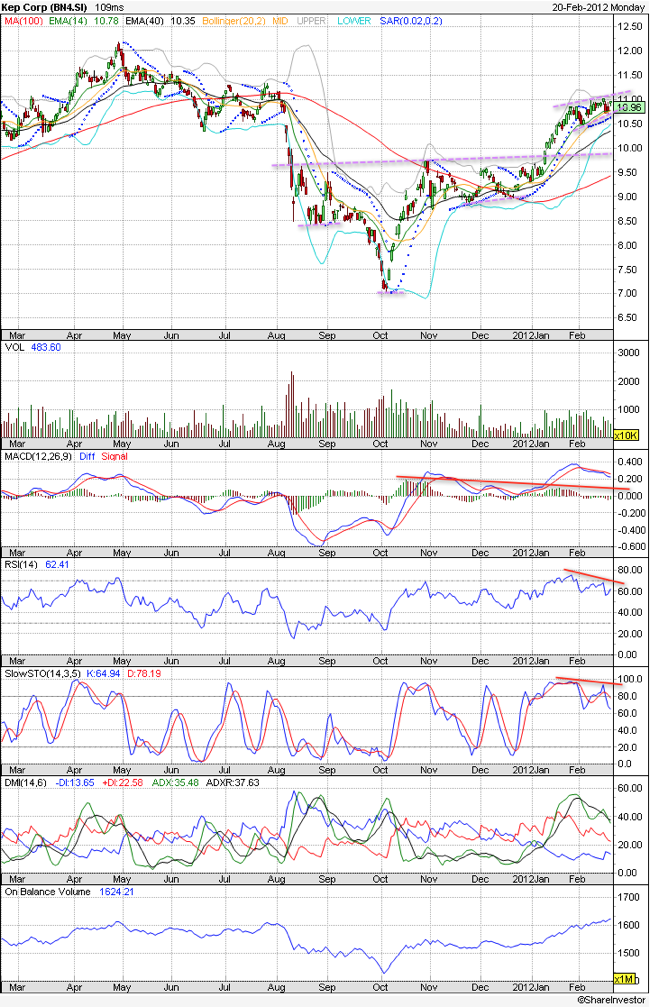

Part 3 : Cyclical sectors as focus during market bottoming – Offshore & Marine (O&M) Stocks | Fundamental Analysis

This is the last sector of my special focus analysis on stock picks during market bottom – Offshore & Marine (O&M) stocks. O&M sector has great volatility due to high dependencies on economic activities & prices of oil. Thus it is important to focus on good Offshore & Marine (O&M) companies with big market capitalization. 5 stocks in particular are…

Part 2 : Cyclical sectors as focus during market bottoming – Commodities Stocks | Fundamental Analysis

In my earlier post (Banking Stocks), we look at the banking sector which is will be the first few to move during a market recovery from multi year lows. For this post, we look at the other potential sector – Commodities. For relatively cheaper valuation commodity stocks, we have Golden Agri, Sakari, Noble Group with good liquidity and strong…

Part 1 : Cyclical sectors as focus during market bottoming – Bank stocks | Fundamental Analysis

Ever since Dec 2011, Singapore Straits Times Index (STI) has managed to U-turn from the lows of 2600 to the current consolidation at 2900-3000. Cyclical sectors are typically the first ti be deeply corrected but also the few which will rally once the market has consolidated our of its bottom. In the 3 part series, lets take a quick overview…

Better than expected US economic data has restored some confidence in sidelined traders | Fundamental Analysis | US Stock Market

US economy has finally shown hope of a recovery, if not definitely signs of bottoming. On Friday, US Stocks took off after the Labor Department reported the addition of 243,000 jobs in January, the largest jump in nine months. The unemployment rate fell to 8.3%, the lowest since February 2009. a) Manufacturing Jobs – Largest growth since Jan 2010. b) Service…

Nokia (NOK) stock has been laggard – the worst is over? | Technical Analysis | US Stocks Market

Nokia (NOK) has been the leading handset maker since 1998 but after reaching its global goal of 40 percent market share in 2008, the Finnish company has been struggling against rivals making cheaper handsets in Asia. That sent Nokia’s global share to below 30 percent last year. Nokia comprises three business groups: Mobile Solutions, Mobile Phones and Markets. The company is…

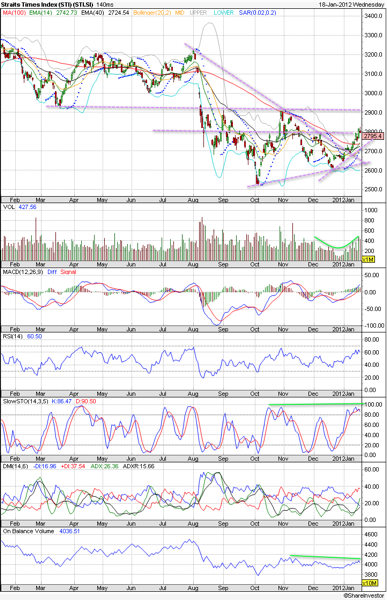

Straits Times Index (STI) – consolidation continues with positive bias | Profit taking for a cheaper re-entry | Singapore Stocks Market

After the gap down for Singapore Straits Times Index in August 2011, the index underwent series of sideway consolidation. Support will be at 2600 and resistance will be at 2900. Mid term wise, the index is poised up though MFI shows that funds are not driving the recent gains. The index should continue its sideway consolidation with positive bias until…