On 5th May 2011, StarHub (CC3) Ltd reported its 1Q11: 1) Revenue inching up 0.2% YoY to S$558.5m (fell 0.1% QoQ due to seasonality), 2) Net profit, on the other hand, jumped 62.1% YoY to S$69.1m (but slipped 14.1% QoQ). StarHub has declared a quarterly dividend of S$0.05/share, payable on 2 Jun 2011. For the entire 2011, StarHub continues to…

Tag: Stock Prices

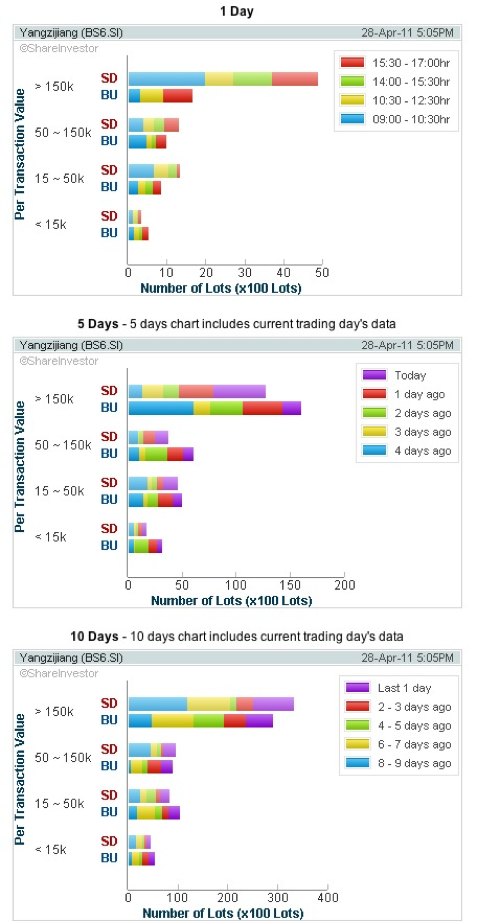

Yangzijiang Shipbuilding (BS6) reports good quarterly results but the prices are not as promising | Technical Analysis | Singapore Stock Market

Yangzijiang Shipbuilding (BS6) reported a 14% YoY rise in revenue to RMB3.05b and a 63% increase in net profit to RMB954.9m in 1Q11.The boost in net profit was mainly contributed by an increase in gross profit margin (27% in 1Q11 vs 23% in 1Q10) and higher other gains comprising mainly foreign exchange gains. 17 vessels were delivered in 1Q11, while…

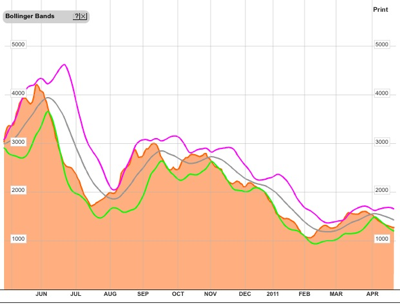

Cosco – short term economic threats should not jeopardise long term recovery | Technical Analysis | Singapore Stocks

It has been awhile since I last touched on Cosco. During Feb 2011 when I last issued a sell call on technical weaknesses, the stock has tested a significant low of $1.80. That was worsened by the Japan Earthquake which causes much anxiety on a standstill or worsening of the world global recovery. Near term basis, shipbuilding activity and traffic…

Singapore Stock Exchange SGX – Start accumulation | Stocks Review | Singapore Stock Market

It was quite an eventful day for SGX between conversations of SGX CEO and Australia’s foreign investment regulator. This will shed some light in the long awaited outcome of the merger deal between SGX & ASX. Earlier this afternoon (5 April 2011, 1300hrs), Singapore Exchange Ltd. (S68.SG) Tuesday said it received notification from Australia’s foreign investment regulator that the Australian…

SIA at good valuation, time to watch out? | Stock Review & Analysis | Singapore

Once a darling among the analysts during the last quarters economy recovery, the stock is battered with series of bad economic developments – Libya outbreak, Japan earthquake and nuclear scare. SIA has also announced the cancellation of some daily flights to Tokyo, Japan. On technical front, SIA has staged a good recovery and bull run since May 2010 at $9.50.…

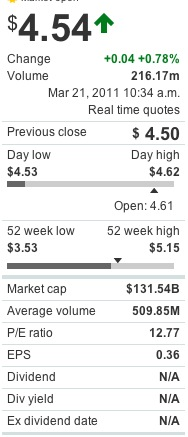

Citigroup C – time to take positions | Stock Prices & Analysis | US

US Banking giant Citigroup (C) announced plans 21 Mar 2011 Monday to conduct a 1-for-10 reverse stock split and resume paying a quarterly dividend.The reverse stock split will slash the number of Citi’s outstanding shares to 2.9 billion from about 29 billion.Citi, which recently finished repaying its $45 billion taxpayer-funded bailout from the financial crisis, said it anticipates the reverse…

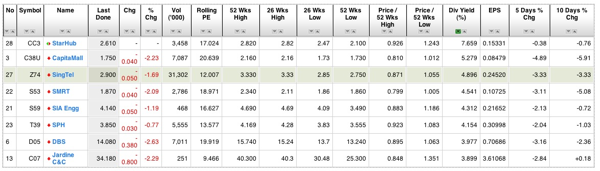

Singapore Blue Chips for Value Plays | Stock Review | Singapore Stock Market

As predicted in my past blog entries, Japan has suffered the 3rd worst intraday price plunge in her history for the Nikkei 225 Index. Stock markets round the world are also not spared: A) Asian Stock Markets: B) European Stock Markets: Likewise, for Singapore Stock Market, the STI has breeched 3000 psychological level to end at 2946.1 (-2.8%). Looking at…

World Stock Markets in jittery with recent Japan Earthquake & Tsunami | Stock Markets | World

While the world has to dealt with the political uncertainties in Libya and the rising inflations from the spikes in world oil prices, Mother Earth has not been any kinder to us. Japan’s most powerful earthquake in more than 100 years killed at least 1,000 people and triggered rising radiation levels at one of the nation’s several nuclear-power plants, according to…

Stock Markets Analysis (Dow Jones Index, Straits Times Index, Oil, USD/SGD) | Investment Review | Singapore

On the political front, Gaddafi’s regime accused the United States, Britain and France of ‘a conspiracy to divide Libya’ on Monday as pressure built to arm the rebels and the UN named a special envoy to Tripoli.The worsening conflict sent world oil prices higher, while Nato head Anders Fogh Rasmussen said attacks on civilians by Gaddafi’s troops could amount to crimes…

Straits Times Index STI – More weakness ahead – Stock Price / Stock Investment – Singapore Stock

The Straits TImes Index STI has breached multiple support in a span of one week, definitely a trend reversal. Funds are rushing out. DI+/DI- is widening with ADX rising. OBV is correcting downwards. Only consolation is to have a slight reprieve with RSI in oversold. 3080 as next support. Failure to hold, index will strike range (3000 – 3080). This…