On 22nd July 2014, Apple (AAPL) announced their latest Q3 2014 results. Comparatively, the results are impressive considering the margins are largely maintained yet on a growing quarterly revenue Y-on-Y. Undeniably, iPhone is still the main revenue generator for Apple (AAPL) followed by iPad. Though for the sales volume for iPad has dipped Y-on-Y. With the upcoming refresh for iPhone…

Tag: US Stocks

Apple stocks plunged 9% after announcing their Q1 2013 results – a bargain buy? | Fundamental Analysis | US Stocks

Apple (AAPL) just announced their fiscal 2013 Q1 results which came in ‘unspectacular’ against what traders were anticipating. Nevertheless, it is still a very decent report card if we do look into the details. Key performance summary: Revenue: $54.5 billion versus $54.58 billion expected EPS: $13.81 versus $13.34 expected Gross Margin: 38.6% versus 39.5% expected iPhone: 47.8 million versus 50…

Investment in Social Media stocks – Quick overview and comparisons | Trading Analysis | US Stocks

The staggering popularity and explosive growth of social media sites like Facebook and Twitter has been a nothing short of phenomenal. For social media space, investors need to ask themselves three key questions: • Is each company building a sustainable platform?• What kind of five-year growth are they capable of achieving?• And what will profits look like when they reach…

Nokia (NOK) stock has been laggard – the worst is over? | Technical Analysis | US Stocks Market

Nokia (NOK) has been the leading handset maker since 1998 but after reaching its global goal of 40 percent market share in 2008, the Finnish company has been struggling against rivals making cheaper handsets in Asia. That sent Nokia’s global share to below 30 percent last year. Nokia comprises three business groups: Mobile Solutions, Mobile Phones and Markets. The company is…

Crocs stock price plunged on unexpected profit warning – opportunity or more bad news? | Technical Analysis | US Stocks Review

On Tues 18th Oct 11, Crocs (CROX) pre-announced earnings and warned about a possible 25% decrease in its earnings for the quarter. Though it provides an early evaluation of the company’s financial performance, the market reaction was still very drastic. In one night (after hours), Crocs lost 38% of its market cap overnight. I have always been a great fan…

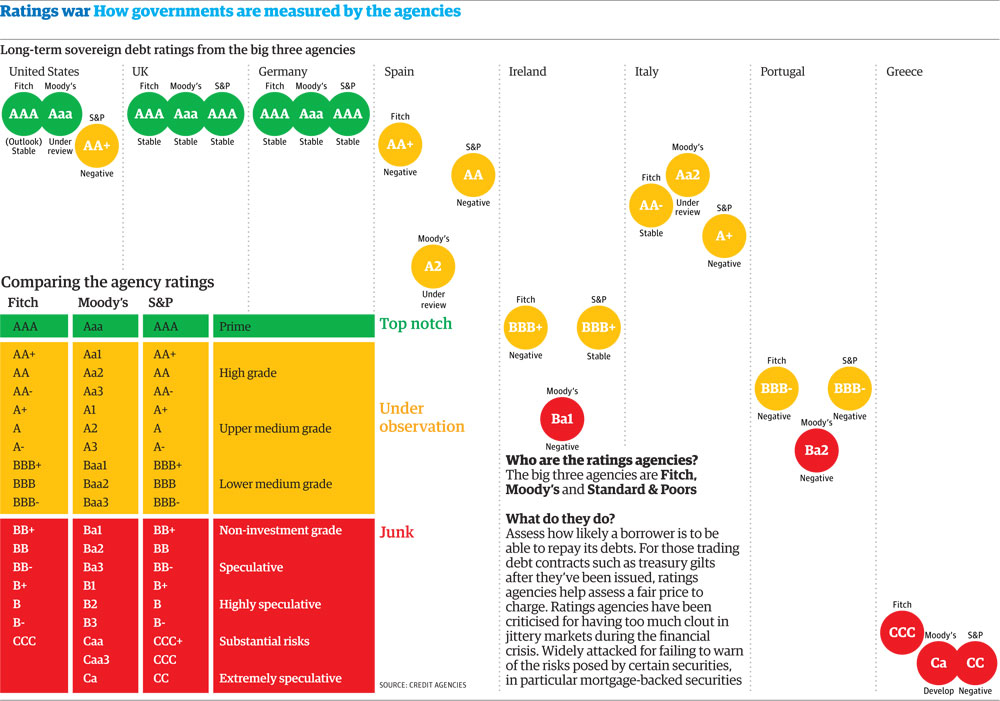

S&P downgrades US from AAA to AA ratings – poor US credit rating with worsening budget deficits | Fundamental Analysis | US

The world ended the week with a tailspin from S&P downgrade of the triple-A (AAA) rating the US has held for 70 years, saying the budget deal recently brokered in Washington didn’t do enough to address the gloomy long-term picture for America’s finances Standard & Poor’s slammed the nation’s political process and criticizing lawmakers for failing to cut spending enough…

Citigroup C – More short term downside – Stock Price / Stock Investment – US Stock Market

Price is now at crucial Bollinger support @ $4.66. If it breaks, HSH is possible with downside towards $4.5. Force index still at negative region with RSI not at bottom levels yet. Hold your bullets and regain towards $4.5+. Follow us on: Share this article on:

Citigroup – Buy on value

Uptrend intact while support @ $4.50 holds. Near term target of $5.00. RSI on rise with enlarging bollinger band. Follow us on: Share this article on: