On Wednesday 22nd June 2011, Greek Prime Minister George Papandreou’s government survived a confidence vote in parliament. This piece of news has injected the needed confidence among the investors who underwent financial market turmoils for the past few weeks. European leaders breathed a sigh of relief but kept up the pressure on Greek Prime Minister George Papandreou, who faces a vote…

Tag: STI

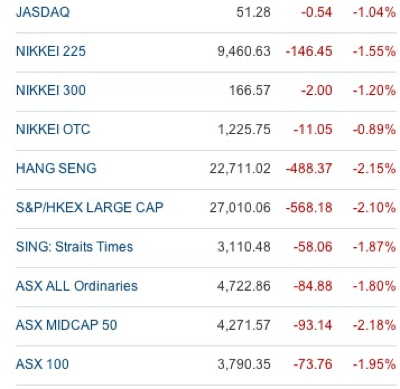

Multi week lows for major stock markets – Dow Jones Industrial, Nasdaq, Straits Times Indices with soft USD $ | Technical Analysis | US Stock & Currency Markets

The market is still digesting that there’s been a softening in economic growth in the U.S. and other parts of the world. This is not surprising as there are signs of bearish divergences in most of the indices technical chartings. The six-week losing period, which has knocked 6.7% from the Dow, is the longest stretch since October 4, 2002, when…

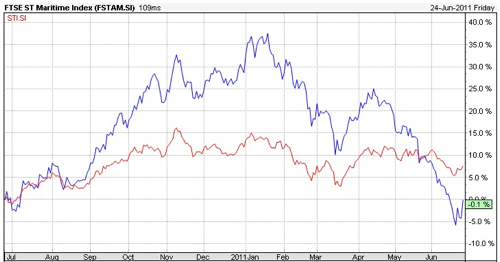

European crisis and China economy slowdown have increased risk aversion | STI, Cosco, Yangzijiang stock prices | US, Singapore Stock Markets

Once again, it was a ‘red’ Monday with all stock markets not spared from the brutal selldowns. Though traditionally, May period is known to most experienced investors as a month of ‘short’ or ‘sell’, this time round, the new anxiety and fear is a result of some key economic developments in UK and China. On Friday (20th May 2011), Fitch…

Straits Times Index after Singapore Elections 2011 | Technical Analysis | Stock Market

It was a very interesting outcome for the Singapore Elections 2011. As anticipated, the ruling party PAP still hold the winning majority of the parliament seats. But what creates uncertainty among the Singapore population is the decreasing winning proportion of the valid votes casted. It has declined from 2006 (66%) to 2011 (60.1%). The opposition party, WP, managed to seize…

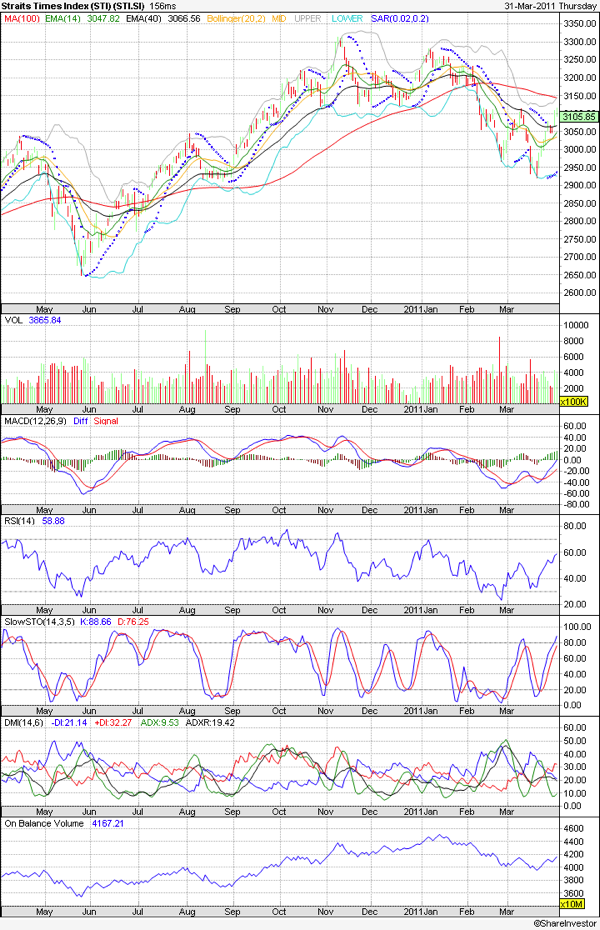

Straits Times Index STI, seeking for a new haven | Stock Market Review | Singapore

Singapore bourse has strongly rebounded from the recent double bottom near Bollinger band 2920 and went past crucial 3000 level recently. This is past 2 moving averages and STI is poised to resume bullish trend. Next important resistance will be at 3150. Volume has been good but not among the highest and this serve to show some investors are still…

Straits Times Index STI – Crucial period, Watch for breakouts | Stock Prices & Market | Singapore

With news of the Japan earthquake & nuclear crisis easing, no further aggravation of Libya’s bombardments, coupled with technical recoveries of US markets (Dow Jones Index, S&P, Nasdaq), Straits Times Index (STI) has also make some good headway with its index value staging a good recovery for almost a week from the trench support. It is now at a crucial…

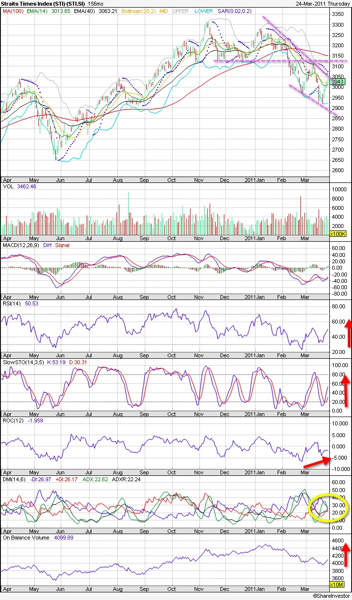

Straits Times Index (STI) – More consolidations for reversal attempts| Technical Analysis | Stock Market | SIngapore

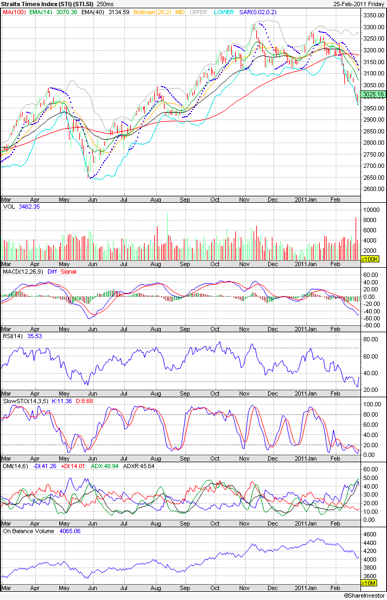

It was a rather turbulent week with investors reassessing political impacts. Straits Times Index (STI) has managed to scale up some nice gains but did not manage to hold past 3065. All indicators are showing initial hit of bottoms – DI+/DI- is crossing, MACD has ticked past 0, OBV is growing, and RSI is improving from the past oversold status.…

Dow Jones, STI and US/SG stock market analysis | Stock Market & Investment | US, Singapore

Since weeks back, I have cautioned all to be nimble about stock market movements lead by the rising negative developments in Libya unrest. Oil production has been disrupted causing oil futures to surge to record high since 2009 and investors rushing into safe haven via USD & Yen, prompting rising strength in both. The latest comforting news are worth to…

Straits Times Index STI – More weakness ahead – Stock Price / Stock Investment – Singapore Stock

The Straits TImes Index STI has breached multiple support in a span of one week, definitely a trend reversal. Funds are rushing out. DI+/DI- is widening with ADX rising. OBV is correcting downwards. Only consolation is to have a slight reprieve with RSI in oversold. 3080 as next support. Failure to hold, index will strike range (3000 – 3080). This…