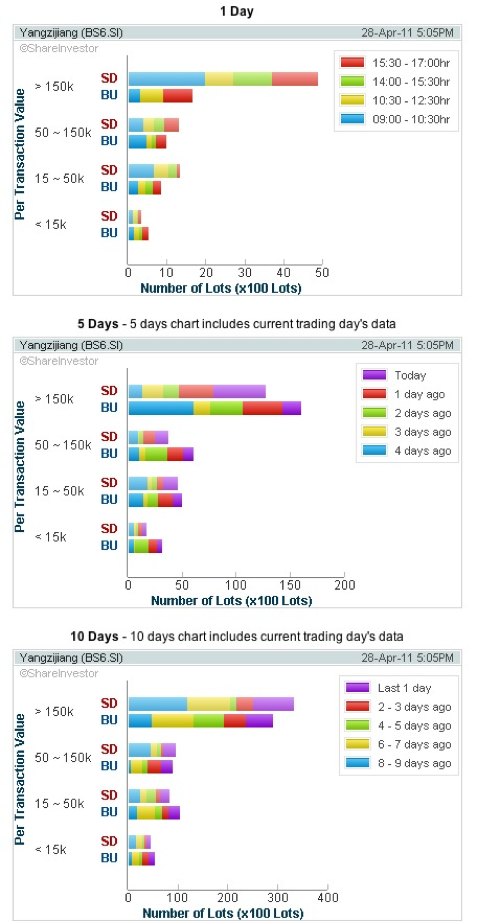

Yangzijiang Shipbuilding (BS6) reported a 14% YoY rise in revenue to RMB3.05b and a 63% increase in net profit to RMB954.9m in 1Q11.The boost in net profit was mainly contributed by an increase in gross profit margin (27% in 1Q11 vs 23% in 1Q10) and higher other gains comprising mainly foreign exchange gains. 17 vessels were delivered in 1Q11, while…

Tag: Technical Analysis

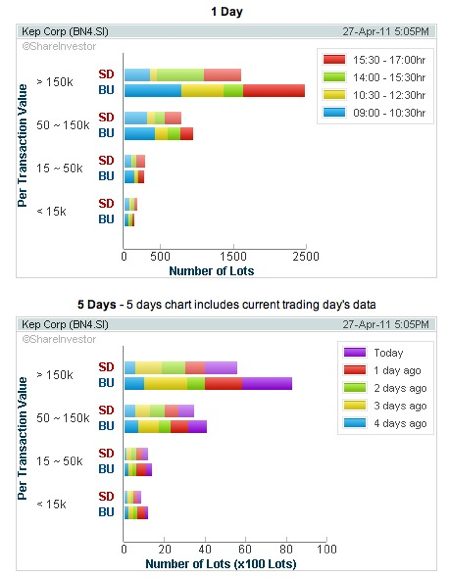

Keppel Corporation (KepCorp) – Rising star to weaken? | Technical Analysis | Singapore Stock Market

KepCorp has always been a blue chip darling since Oct where its stock price has been in uptrend since then from a value of $8.50 to as high as $12.90, representing a return of more than 50% within 6 months. Stock price are well supported by the moving averages and PSAR. Upward channel is still intact. However, when it still…

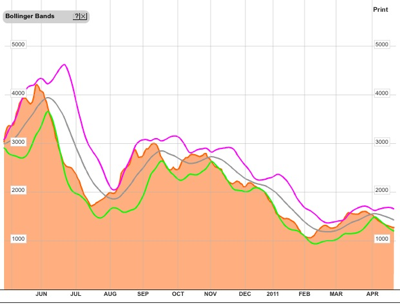

Cosco – short term economic threats should not jeopardise long term recovery | Technical Analysis | Singapore Stocks

It has been awhile since I last touched on Cosco. During Feb 2011 when I last issued a sell call on technical weaknesses, the stock has tested a significant low of $1.80. That was worsened by the Japan Earthquake which causes much anxiety on a standstill or worsening of the world global recovery. Near term basis, shipbuilding activity and traffic…

Genting.SP has more price consolidations ahead | Stocks Review | Singapore Stocks Market

Ever since the Genting stock price touched its historical high of S$2.34, it has then undergone a series of downward consolidation within $0.200 price channel. The recovery from the 3 months low from S$1.85 provided some hope to breakout of the consolidation channel but the divergences in both its daily volume and MACD were signs of disappointment. Watch out if…

SIA at good valuation, time to watch out? | Stock Review & Analysis | Singapore

Once a darling among the analysts during the last quarters economy recovery, the stock is battered with series of bad economic developments – Libya outbreak, Japan earthquake and nuclear scare. SIA has also announced the cancellation of some daily flights to Tokyo, Japan. On technical front, SIA has staged a good recovery and bull run since May 2010 at $9.50.…

Technical Analysis of Crude Oil, Gold | Commodity Prices | CBOT, CME, NYBOT

Political & economic situations should see some light of stability in coming week. Apart from movements in global stock markets, futures market should see further price swings. More importantly, there will be important US economic data to be released this coming week: – Jobless Claims (Thurs)– GDP, Consumer Sentiment (Fri) CRUDE OIL Crude oil has breakout of $93 and since…