Earlier this week, Snap through Morgan Stanley, Goldman Sachs and J.P. Morgan managed to sell 145 million shares in Snap at $17 a share and raised a total of $2.45 billion in cash. Much to some surprise, Snap actually managed to close at $24.48 at Day 1 of IPO, up $7.48 per share or a good 44% jump from its…

Tag: stocks

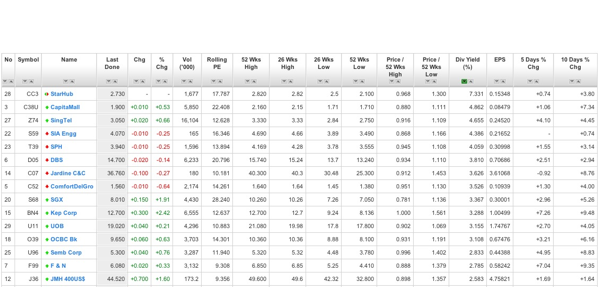

Stock Picks – Good bargain Singapore Stocks for buying and slow accumulation on price weaknesses | Fundamental Analysis | Singapore Stock Market

Stock market crashed multiple times in entire history and being humans we are always affected by fear & anxiety. We will ask the same question whenever it happens – “Will it go lower?”, “It is only the start…?”, “What’s wring with everyone?”, “When can we enter?” … Like any other technical and fundamental (2in1) analyst, we have the advantage to…

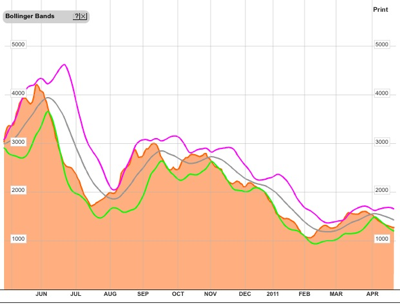

Starhub (CC3) – a good defensive play during uncertainty period and post Singapore Election 2011 | Technical Analysis | Stock Markets

On 5th May 2011, StarHub (CC3) Ltd reported its 1Q11: 1) Revenue inching up 0.2% YoY to S$558.5m (fell 0.1% QoQ due to seasonality), 2) Net profit, on the other hand, jumped 62.1% YoY to S$69.1m (but slipped 14.1% QoQ). StarHub has declared a quarterly dividend of S$0.05/share, payable on 2 Jun 2011. For the entire 2011, StarHub continues to…

Cosco – short term economic threats should not jeopardise long term recovery | Technical Analysis | Singapore Stocks

It has been awhile since I last touched on Cosco. During Feb 2011 when I last issued a sell call on technical weaknesses, the stock has tested a significant low of $1.80. That was worsened by the Japan Earthquake which causes much anxiety on a standstill or worsening of the world global recovery. Near term basis, shipbuilding activity and traffic…

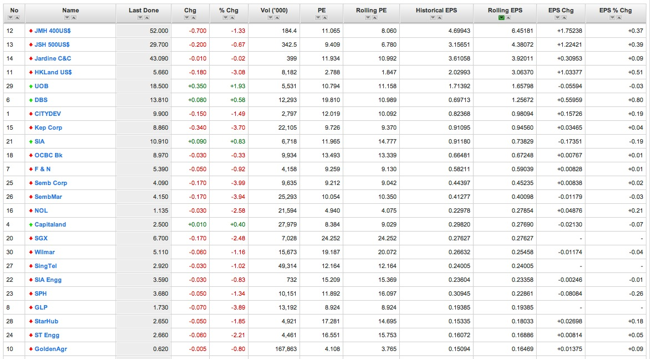

Bargain hunting in Singapore Stocks | Investment Tips | Singapore Stock Market

As predicted, STI comes close to the 3150 resistance with a day turnover volume of 1.35 bil, slight short of the 1.6 bil required to signify significant funds injections. At current rate of growth for the past consecutive days, most of the STI components would have reversed on the short term. Will there be any under-performed stocks worth considering? I…