As of last week, world crude oil prices have dropped to the lowest price in eight months after U.S. stockpiles unexpectedly increased and a report signaled China’s manufacturing will shrink in Jun 2012. At one stage, oil fell nearly $3 on Thurs (21 Jun) to dip below $80 for the first time since October 2011. Typically, oil price is prone…

Tag: Keppel Corp

Keppel Corp (KepCorp) – Stock with good valuation amidst weak market sentiments | Accumulate on price weaknesses | Singapore Stocks Review

Keppel Corp (KepCorp) is among the Singapore Blue Chips which was highlighted in my previous post on good valued stocks to keep a watch out during this financial volatility. Keppel Corp is a Singapore-based conglomerate with businesses engaged in rig-building, utility operation, and property development/investment. The company is one of the world’s largest rig-builders in terms of global market share.…

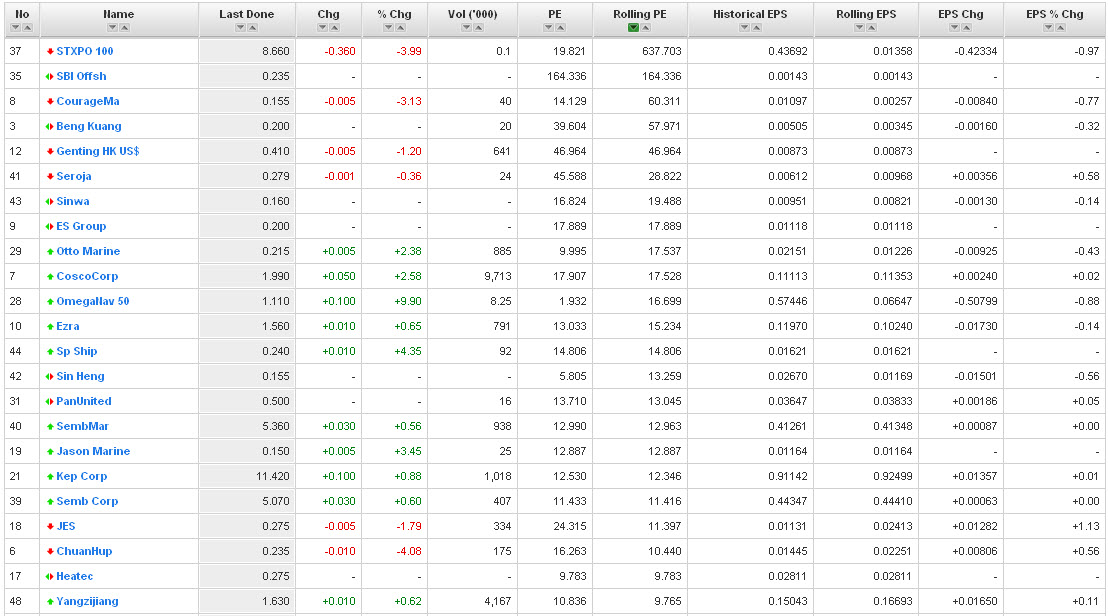

Marine / Rig / Shipping stocks underperform against STI? | Stock Prices Technical Analysis | Singapore Stock Market

It is the last day of a dreaded month of May for 2011. Historically, this month is avoided by retail investors as it is a month of volatility and consolidation. Not aided by the undesirable impact of series of downgrades in various faltering European countries e.g. Spain and a slowdown in greater China market and Singapore latest GDP results do…

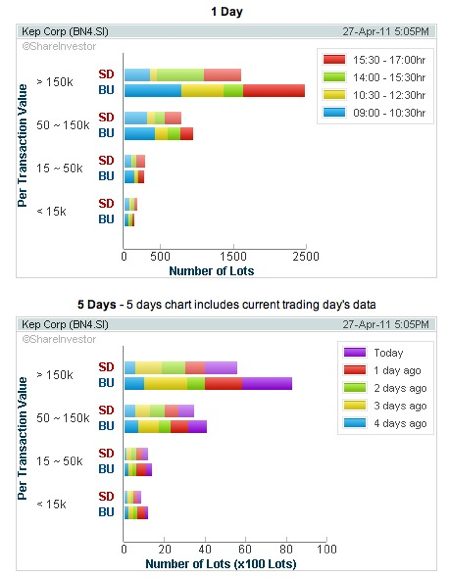

Keppel Corporation (KepCorp) – Rising star to weaken? | Technical Analysis | Singapore Stock Market

KepCorp has always been a blue chip darling since Oct where its stock price has been in uptrend since then from a value of $8.50 to as high as $12.90, representing a return of more than 50% within 6 months. Stock price are well supported by the moving averages and PSAR. Upward channel is still intact. However, when it still…

Keppel Corporation (Kep Corp) – Accumulate on Weakness – Stock Price / Stock Investment – Singapore Stock Market

Price is on NHNL but MACD & RSI showing divergence. Price weakness to last for a while but has trong support towards S$11.6 and S$11.0. Based on last result earnings, true value at $14.00 which translates a upside potential of 30-40%. Follow us on: Share this article on: