Earlier this week, Snap through Morgan Stanley, Goldman Sachs and J.P. Morgan managed to sell 145 million shares in Snap at $17 a share and raised a total of $2.45 billion in cash. Much to some surprise, Snap actually managed to close at $24.48 at Day 1 of IPO, up $7.48 per share or a good 44% jump from its…

Tag: Investment

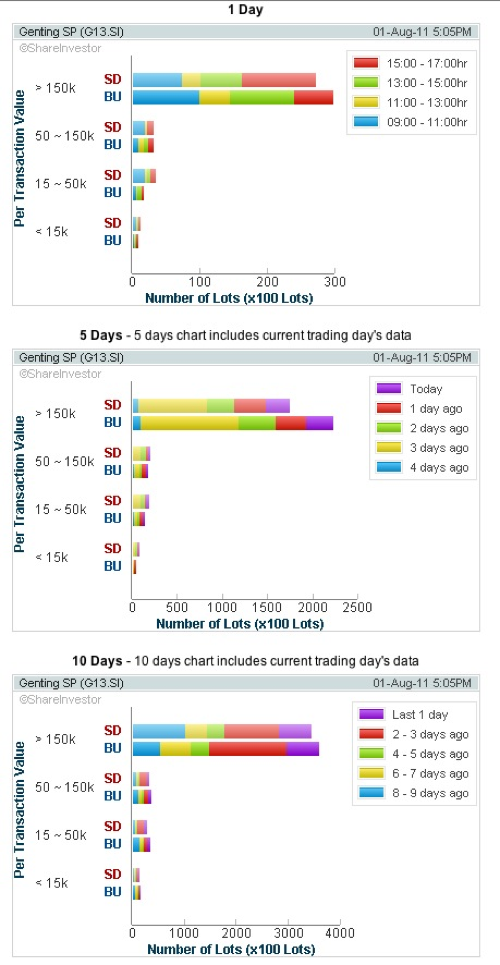

Genting stock has reversed with price breakout – Accumulate at dips ahead of its results | Technical Analysis | Singapore Stock Market

On 27th Jul 2011, Marina Bay Sands (MBS) reported 2Q11 results which exceeded our and market expectation of a seasonally softer rolling chip volume 2Q11. 2Q11’s strong growth in rolling chip volume bodes well for the industry, and implies good long-term prospects for both the industry and rival Resorts World Sentosa (RWS) as VIP gamers typically patronise both casinos. Parent…

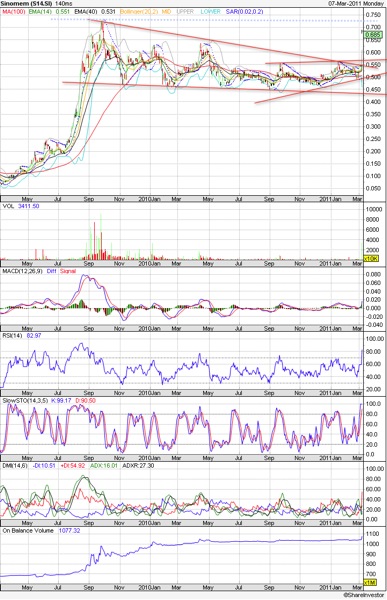

Sinomen Technology (S14.SG) | Surge with takeover | Stock Market & Investment | Singapore

Prices of Sinomen Technology surged & gap up today on the nes of its takeover by Clean Water Investment at S$0.70 per share (31.6% premium to Sinomen’s NAV/Share) and 28.4% premium. Key resistance will be at 0.725 which represent upside at only 6%. Accumulate at consolidation towards S$0.65 will be favorable. Key support will now be at $0.575. OBV has…

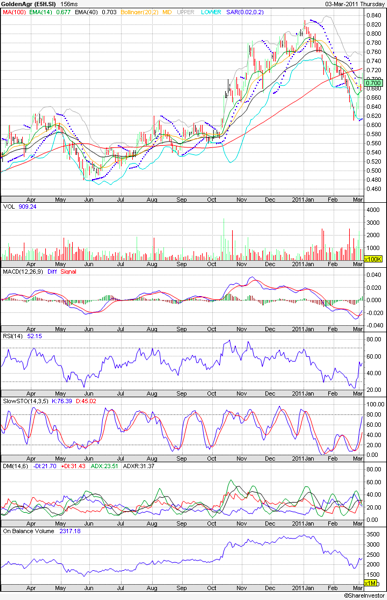

Golden Agri – Bottom formation | Stock Prices & Investment | Singapore Market

As forecasted, with the general political instability and rising oil prices, most Singapore stocks suffered a rapid correction since Jan 2010. Golden Agri also suffered reversal from the peak of $0.83 all the way piercing through several MA support lines and reach a bottom support of $0.61. A visible bullish engulfing candlestick formation was formed and the prices have recovered…

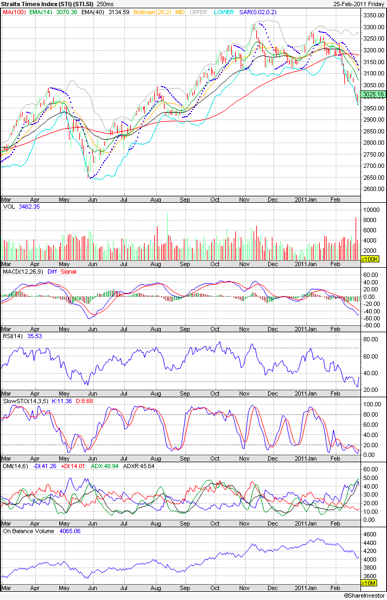

Dow Jones, STI and US/SG stock market analysis | Stock Market & Investment | US, Singapore

Since weeks back, I have cautioned all to be nimble about stock market movements lead by the rising negative developments in Libya unrest. Oil production has been disrupted causing oil futures to surge to record high since 2009 and investors rushing into safe haven via USD & Yen, prompting rising strength in both. The latest comforting news are worth to…

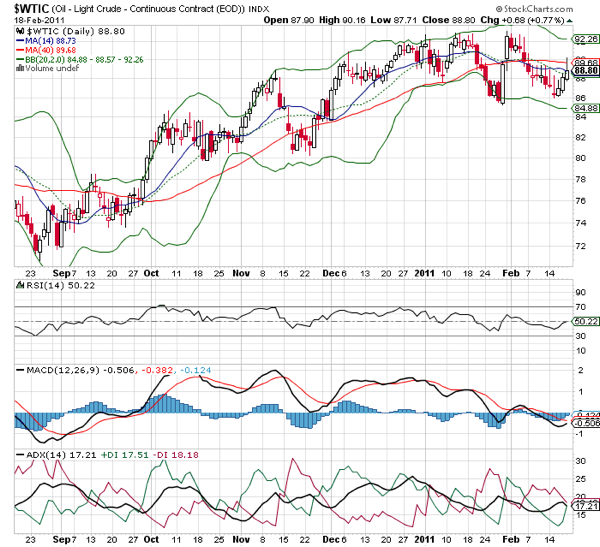

Gold / Light Crude Oil – Further strength amidst uncertainty in Egypt – Commodities

Unrest in North Africa (Libya) and the Middle East (Egypt) has sent uncertainties in investors prompting them to look once again in safe haven via commodities – Gold & Oil. Particularly for Gold, with the formation of bullish piercing reversal formation during early Feb 2011, the prices have reversed from the lows of US$1300 to now $1380+. It is poised…