DBS PayLah! is the lastest milestone in the Singapore banking industry towards mobile payment facility With DBS PayLah! you can send and receive money instantly on your phone. All you need is your buddyís mobile number. DBS PayLah! can be downloaded for free from Google Play Store or iTunes App Store.A personal password is required to access…

Tag: dbs

Retracement for Singapore Stocks – Time to value pick SG Financial Stocks? | DBS, UOB, OCBC Banks | Singapore Stocks Market

For the past week, global markets including Singapore have suffered continued weakness arising from general expectations for Fed to reduce QE and a stronger Yen. These triggered investors to unwind their positions in equities and even the commodities market was not spared. That said, it does present a good opportunity to consider value entry. Particularly, the ST Financial Index has…

DBS (D05.SI) shares plummets after intended acquisition of Bank Danamon – accumulate or sell off? | SG Stocks Review

On 2nd April 2012, DBS Group Holdings (D05.SI) made an announcement that it is acquiring a 67.4% stake in Bank Danamon for S$6.2b. DBS is largely held by Singapore’s state-run Temasek Holdings and mentioned that it will pay its parent company 45.2 trillion rupiah($4.9 billion) in new shares for its 67% stake and buy the remaining stock from other shareholders for 21.2…

Part 1 : Cyclical sectors as focus during market bottoming – Bank stocks | Fundamental Analysis

Ever since Dec 2011, Singapore Straits Times Index (STI) has managed to U-turn from the lows of 2600 to the current consolidation at 2900-3000. Cyclical sectors are typically the first ti be deeply corrected but also the few which will rally once the market has consolidated our of its bottom. In the 3 part series, lets take a quick overview…

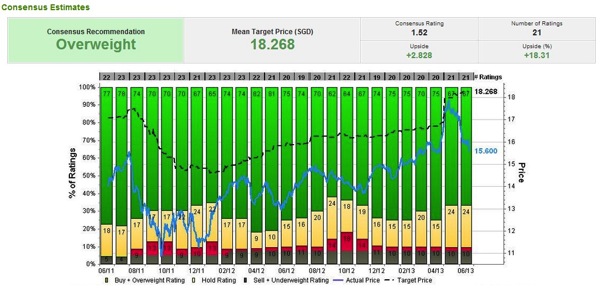

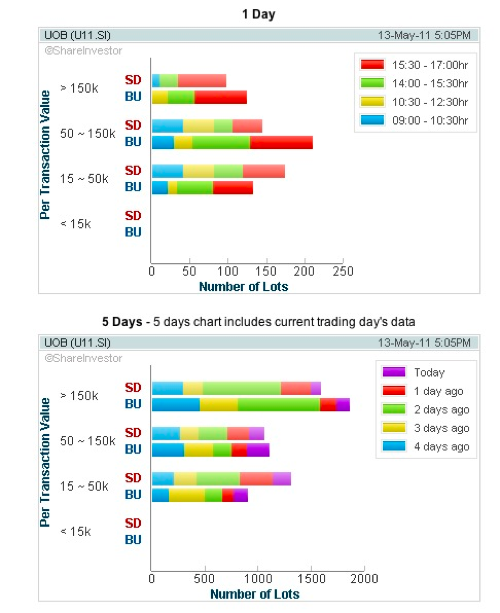

Singapore Banks – DBS (D05.SI), OCBC (O39.SI), UOB (U11.SI) – Accumulate on further stock price dips | Technical Analysis | Singapore Stock Market

After the Singapore Elections 2011, now it is the time to re-focus on the growth potential of Singapore Economy. As domestic activities increase, banks will be the key group of stocks to benefit, DBS has the greatest PE of 20 while UOB has the lowest PE of 11.4.Net earning growth % is the strongest in UOB. Based on the fundamentals…