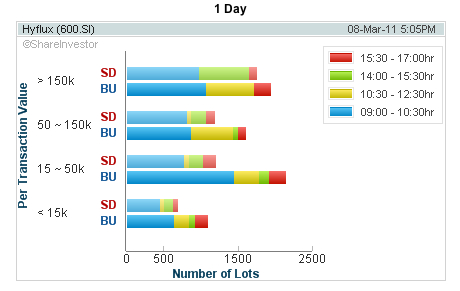

Hyflux stock surged a good 12% from previous day close. There is a series of Buy calls from various broking firms (DBS Vickers, Kim Eng) and after winning for Singapore’s second desalination plant at Tuas. Technical wise, Hyflux failed to breach top resistance of $2.4 during Jan 2011 and thereafter it corrected downwards through multiple Moving Averages. As anticipated, the…

Tag: Stock Market

Sinomen Technology (S14.SG) | Surge with takeover | Stock Market & Investment | Singapore

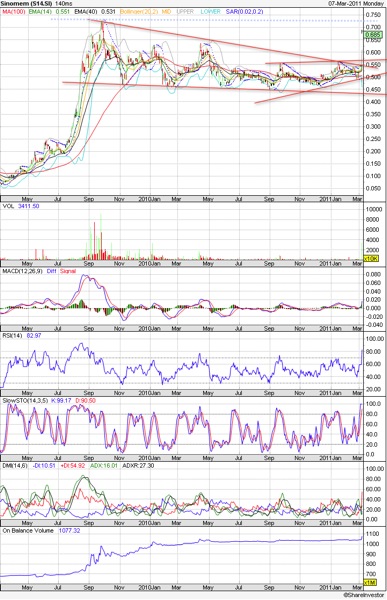

Prices of Sinomen Technology surged & gap up today on the nes of its takeover by Clean Water Investment at S$0.70 per share (31.6% premium to Sinomen’s NAV/Share) and 28.4% premium. Key resistance will be at 0.725 which represent upside at only 6%. Accumulate at consolidation towards S$0.65 will be favorable. Key support will now be at $0.575. OBV has…

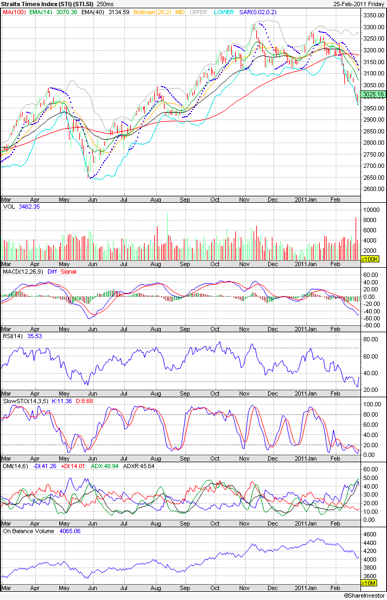

Straits Times Index (STI) – More consolidations for reversal attempts| Technical Analysis | Stock Market | SIngapore

It was a rather turbulent week with investors reassessing political impacts. Straits Times Index (STI) has managed to scale up some nice gains but did not manage to hold past 3065. All indicators are showing initial hit of bottoms – DI+/DI- is crossing, MACD has ticked past 0, OBV is growing, and RSI is improving from the past oversold status.…

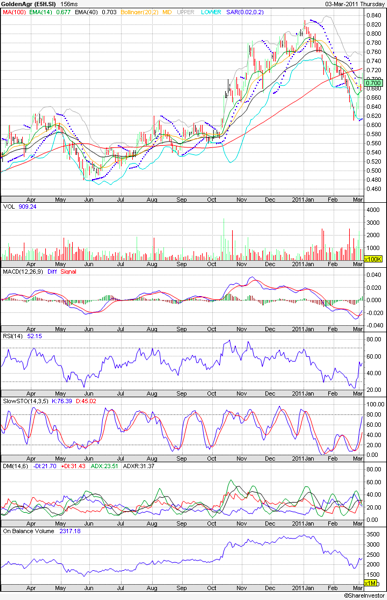

Golden Agri – Bottom formation | Stock Prices & Investment | Singapore Market

As forecasted, with the general political instability and rising oil prices, most Singapore stocks suffered a rapid correction since Jan 2010. Golden Agri also suffered reversal from the peak of $0.83 all the way piercing through several MA support lines and reach a bottom support of $0.61. A visible bullish engulfing candlestick formation was formed and the prices have recovered…

Dow Jones, STI and US/SG stock market analysis | Stock Market & Investment | US, Singapore

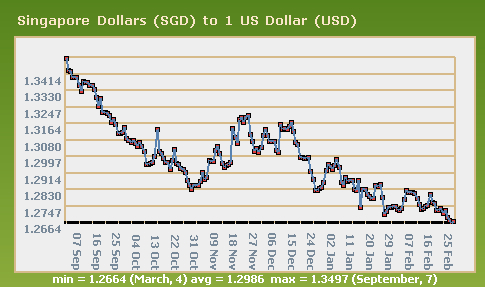

Since weeks back, I have cautioned all to be nimble about stock market movements lead by the rising negative developments in Libya unrest. Oil production has been disrupted causing oil futures to surge to record high since 2009 and investors rushing into safe haven via USD & Yen, prompting rising strength in both. The latest comforting news are worth to…

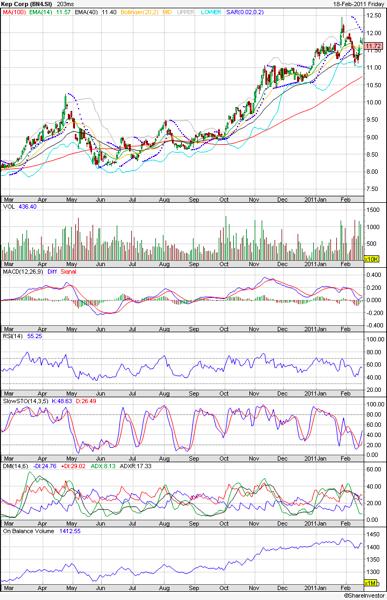

KepCorp – Mid term uptrend intact – Singapore Stock Price / Market

With new book orders, it is one of the good stock which bucked the downward trend of STI main stock components. Near term there should be some further consolidations before the price breakout of S$12. For good risk appetite investors, you can consider accumulating on weakness. Follow us on: Share this article on:

Straits Times Index STI – More weakness ahead – Stock Price / Stock Investment – Singapore Stock

The Straits TImes Index STI has breached multiple support in a span of one week, definitely a trend reversal. Funds are rushing out. DI+/DI- is widening with ADX rising. OBV is correcting downwards. Only consolation is to have a slight reprieve with RSI in oversold. 3080 as next support. Failure to hold, index will strike range (3000 – 3080). This…

Keppel Corporation (Kep Corp) – Accumulate on Weakness – Stock Price / Stock Investment – Singapore Stock Market

Price is on NHNL but MACD & RSI showing divergence. Price weakness to last for a while but has trong support towards S$11.6 and S$11.0. Based on last result earnings, true value at $14.00 which translates a upside potential of 30-40%. Follow us on: Share this article on:

Citigroup C – More short term downside – Stock Price / Stock Investment – US Stock Market

Price is now at crucial Bollinger support @ $4.66. If it breaks, HSH is possible with downside towards $4.5. Force index still at negative region with RSI not at bottom levels yet. Hold your bullets and regain towards $4.5+. Follow us on: Share this article on:

Golden Agri – More weakness – Stock Price / Stock Investment – Singapore Stock Market

Overall, the indexes are poised for some short term corrections. Into the new 2011, commodities stocks should have sufficient runway esp a generally weakening of USD. Strong support at $0.66, slow accumulation for those with bigger risk appetite. Follow us on: Share this article on: