For the past week, global markets including Singapore have suffered continued weakness arising from general expectations for Fed to reduce QE and a stronger Yen. These triggered investors to unwind their positions in equities and even the commodities market was not spared. That said, it does present a good opportunity to consider value entry. Particularly, the ST Financial Index has…

Tag: OCBC

Part 1 : Cyclical sectors as focus during market bottoming – Bank stocks | Fundamental Analysis

Ever since Dec 2011, Singapore Straits Times Index (STI) has managed to U-turn from the lows of 2600 to the current consolidation at 2900-3000. Cyclical sectors are typically the first ti be deeply corrected but also the few which will rally once the market has consolidated our of its bottom. In the 3 part series, lets take a quick overview…

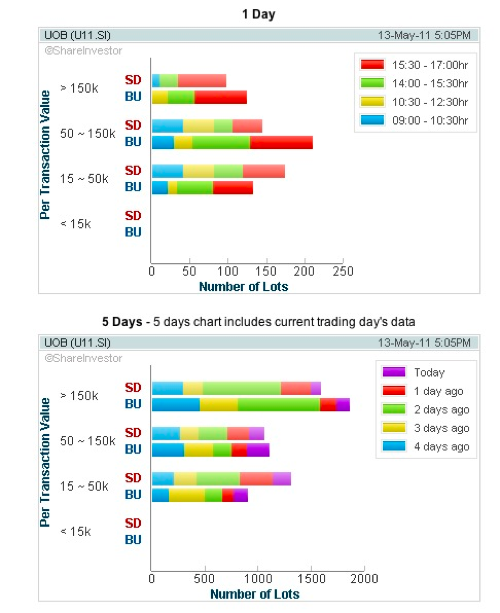

Singapore Banks – DBS (D05.SI), OCBC (O39.SI), UOB (U11.SI) – Accumulate on further stock price dips | Technical Analysis | Singapore Stock Market

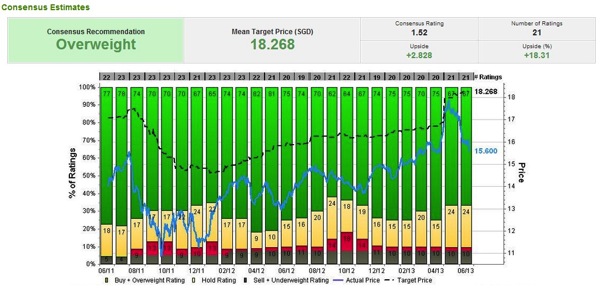

After the Singapore Elections 2011, now it is the time to re-focus on the growth potential of Singapore Economy. As domestic activities increase, banks will be the key group of stocks to benefit, DBS has the greatest PE of 20 while UOB has the lowest PE of 11.4.Net earning growth % is the strongest in UOB. Based on the fundamentals…

OCBC – Stock Investment Tips (Buy on Weakness)

OCBC has been running up lately from the last breakout @ $9.20. Now its at a upchannel support @$10.00. Long Term support @ $9.60 with near term target of $10.90. On economic front, SGD should strengthen and propel local investments but the risk of lower loans from the series of property cooling measures could curtail big up surges. Nevertheless, this…