DBS PayLah! is the lastest milestone in the Singapore banking industry towards mobile payment facility

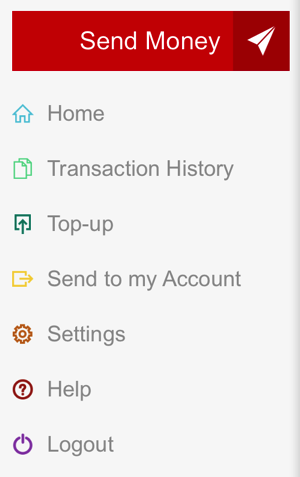

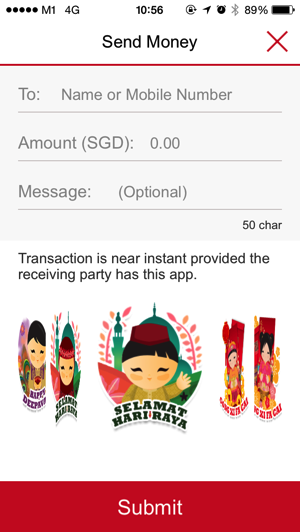

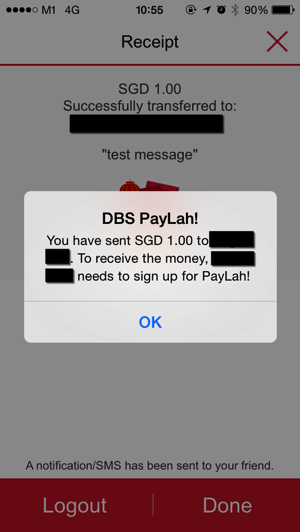

With DBS PayLah! you can send and receive money instantly on your phone. All you need is your buddyís mobile number.

DBS PayLah! can be downloaded for free from Google Play Store or iTunes App Store.

A personal password is required to access and use the DBS PayLah! app.

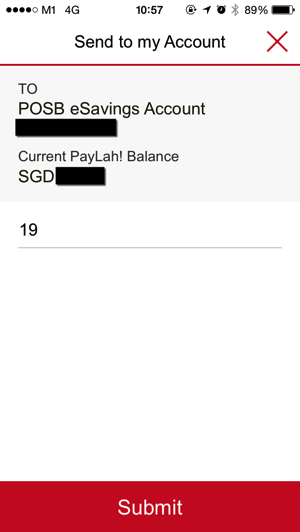

As a mobile wallet with a higher daily limit of SGD 999, PayLah also allows for greater flexibility in payment usage. For instance, it can be used to pay the helperís salary, give children pocket money and to pay for purchases with sole proprietorships such as blog shops or taxi rides.

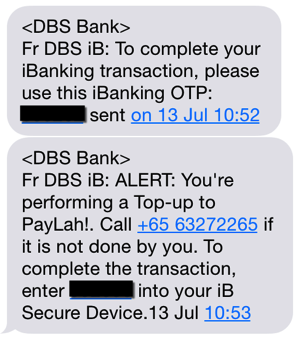

The iBanking token is required for the first time top-up only.

Other competing service offered by other Singapore banks:

a) Dash (by SingTel and Standard Chartered Bank)

– Need to apply to get a mCash account from SingTel

– Need to apply a linked Dash Easy Savings Account from Standard Chartered

– Send & Recieve by mobile number

b) OCBC Pay Anyone

– need to be an existing OCBC internet banking customer with existed savings / current account

– can send money to your friends via mobile number, email address, and even facebook account. You friends can use any Singapore savings / current account to receive the money.

c) Maybank Mobile Money

– need to be an existing Maybank internet banking customer with existed savings / current account

– can send money to your friends via mobile number. You friends can use any Singapore savings / current account to receive the money.

Read other related posts:

Follow us on:

Share this article on: