STI has been consolidating since Aug 2013 within a tight band. Current support is at 3080 & its resistance at 3180. Momentum is also slowing with bearish divergence forming at both volume & MACD indicators. More convincing breakout should happen beyond 3200. Quick look at some key FTSE ST Indices: A) FTSE ST Financials Index (FSTAS8000.SI)– Short term movement :…

Tag: Stock Market

Retracement for Singapore Stocks – Time to value pick SG Financial Stocks? | DBS, UOB, OCBC Banks | Singapore Stocks Market

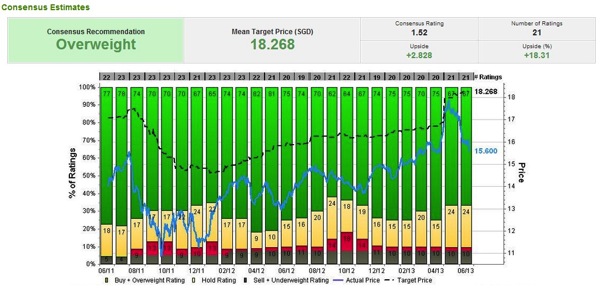

For the past week, global markets including Singapore have suffered continued weakness arising from general expectations for Fed to reduce QE and a stronger Yen. These triggered investors to unwind their positions in equities and even the commodities market was not spared. That said, it does present a good opportunity to consider value entry. Particularly, the ST Financial Index has…

SoftBank makes aggressive investment in Sprint – short term dilution but long term strategic move | M&A | Stock Market

One of Japan’s largest wireless carriers, SoftBank Corp is spending $20.1 billion to gain a foothold in one of the world’s biggest and most lucrative mobile markets. SoftBank Corp., Japan’s third-largest carrier, is taking a 70% stake in struggling U.S. carrier Sprint Nextel Corp. It would mark the largest-ever overseas acquisition by a Japanese company. Softbank Corp.’s $20 billion takeover…

Temasek sells stake in SingTel – opportunity to accumulate on short term price weaknesses | Singapore Stock Market

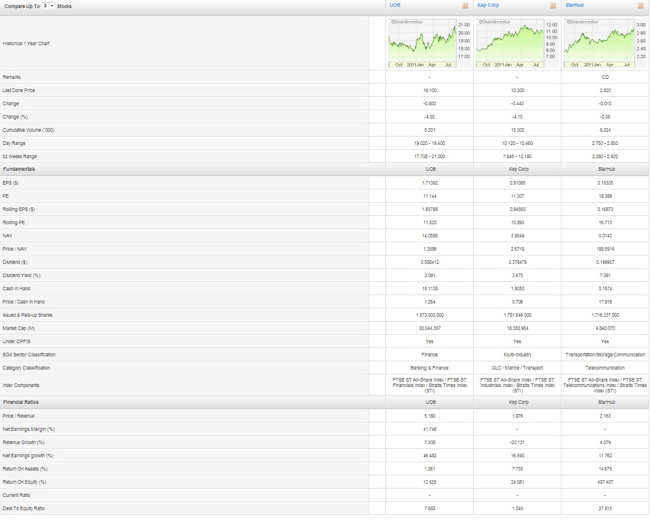

Just as the Singapore Market is undergoing a band consolidation after the breakout of 3000 level, Temasek Holdings announced on Wed that it is selling 400 million shares in Singapore Telecommunications Ltd (SingTel). The deal has an upsize option to sell an additional 100 million shares if the demand is strong. Temasek owned 54.4 percent of SingTel as of 31 March 2012. It…

Financial sector a big laggard or a sign of bigger storm ahead? | Technical Analysis | US Stock Market

For the past quarter in 2012, Dow Jones Industrial has seen a steady upward price momentum with key indicators also ticking up. Nevertheless, the volume has not been too comforting, coupled with much in-decisiveness depicted in wide weekly range swings and doji formations. Interestingly, the DJ Financial Index has been a big laggard against the general DJI components. It is…

Nokia (NOK) stock has been laggard – the worst is over? | Technical Analysis | US Stocks Market

Nokia (NOK) has been the leading handset maker since 1998 but after reaching its global goal of 40 percent market share in 2008, the Finnish company has been struggling against rivals making cheaper handsets in Asia. That sent Nokia’s global share to below 30 percent last year. Nokia comprises three business groups: Mobile Solutions, Mobile Phones and Markets. The company is…

Sheng Siong Group (SSG) – a dividend play during volatile periods | Stock Review | Singapore Stock Market

Sheng Siong Group (SSG) offers a good defensive play especially during volatile Singapore stock market conditions. It has strong fundamentals and healthy balance sheet. Key strengths/Prospects: 1) Supported by strong domestic demands & good marginsFresh produce contributes about 30% to its revenue, with strong gross profit margins ranging from 21% toas high as 30%.No matter its good or bad days,…

Blackberry maker RIM releases poor financial results, stock price falls – a value play? | US Stocks Review

RIM’s results of the past three months are $239 million, as compared to the $695 million in the previous quarter or $797 million at the same time, last year. This has triggered worries among investors, sending its stock price plummeting by 22% on intraday lows last Friday (16th September 2011). In order to have a decent financial profit turnaround, RIM…

Finding silver lining among Stock Market major declines and increase risk aversion | Fundamental Analysis | Global Stocks Market

On Thurs (8th Aug 2011), the three benchmark stock indexes (Dow Jones Industrial, Nasdaq and S&P) all crashed into negative territory for the year. Oil also dropped sharply on thoughts of reduced global demand and even the safe haven gold sank as investors cut holdings to cover stock positions. Naturally, Treasurys and the dollar rallied. By then end of Thursday US…

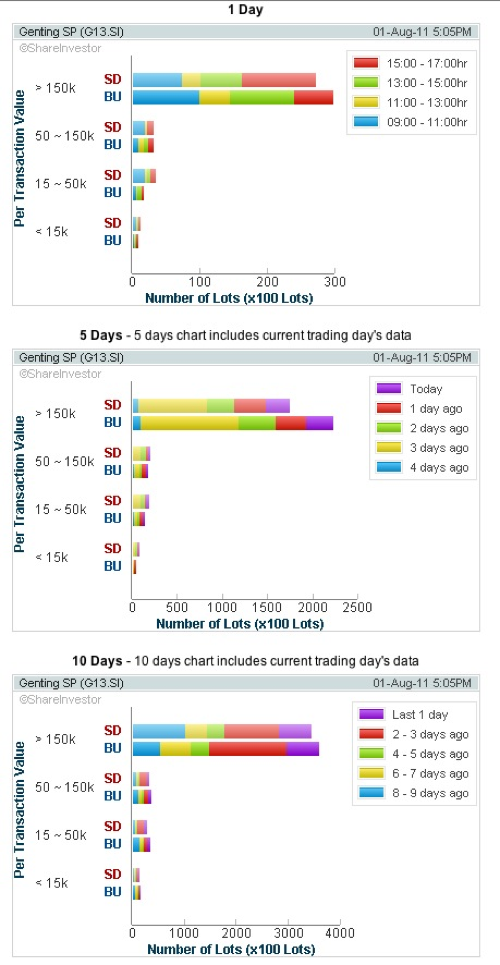

Genting stock has reversed with price breakout – Accumulate at dips ahead of its results | Technical Analysis | Singapore Stock Market

On 27th Jul 2011, Marina Bay Sands (MBS) reported 2Q11 results which exceeded our and market expectation of a seasonally softer rolling chip volume 2Q11. 2Q11’s strong growth in rolling chip volume bodes well for the industry, and implies good long-term prospects for both the industry and rival Resorts World Sentosa (RWS) as VIP gamers typically patronise both casinos. Parent…